Encourage visitors to extend stays by offering 4–7 day luxury packages across multiple regions, paired with exclusive experiences. This shifts demand from overcrowded hotspots to scenic provinces and helps protect communities while building premium revenue.

unwto data suggests that the pacific and americas markets show growing appetite for longer, immersive visiting holidays. Tourists who have traveled know they want itineraries that balance iconic sites with hidden gems. Visitors from canada and other foreign markets bring friends and families, expanding the americas market while keeping budget expectations realistic.

France will promote region-rich experiences across different types of holidays: gastronomy, wine, heritage, nature, spa, and luxury shopping. By pairing stays in boutique lodgings with private tours, the program targets travelers seeking premium experiences while keeping a measurable price point. This helps record-breaking demand spread more evenly and reduces pressure on Paris and the riviera.

Strategic planning should include cross-regional cooperation, data sharing, and a transparent status dashboard to monitor occupancy. The approach connects Loire, Provence, Brittany, and Corsica via rail and road, reducing congestion at the capital while boosting rural economies. The same approach works in urban cores and rural towns, ensuring benefits reach local communities and preserving borders where needed.

To measure progress, government and industry groups will track metrics such as average stay length, record-breaking arrivals year over year, and the share of tourists visiting multiple regions. The pricing strategy supports budget and luxury segments alike with dynamic bundles that adapt to demand. This aligns with unwto guidance and makes data-driven decisions.

Know your audiences and tailor offers: domestic travelers seeking luxury experiences and international guests from foreign markets will respond to curated itineraries that emphasize local culture and sustainable practices. The market is steering France toward year-round, multi-region holidays that respect borders and communities, creating durable benefits for tourism, residents, and small businesses alike, making the plan sustainable.

Incentivizing Longer Stays: France’s Policy Levers for Travelers

Provide a free night for stays of 10+ nights ve bir 20% discount on a second luxury experience for outbound travellers. This shift aligns incentives with longer engagements, encouraging travellers who have travelled to France before to extend their stay and deepen their experiences, reducing mass visits at peak sites.

A six-month pilot across several regions showed a little uplift in multi-night bookings and a more stable occupancy when seasonal demand dipped. Overseas visitors from portugal ve switzerland accounted for the largest share of the new, longer-stay bookings, with foreign travellers reaching France’s most popular areas. After the pilot, average stay length rose by 1.5 nights on outbound itineraries, signaling a positive shift in where travellers allocate time.

The policy lever package rests on three tracks: incentives for providers, streamlined access, and targeted marketing. A tax credit for hotels and camping sites that offer 7+ night packages, plus visa-on-arrival simplifications for overseas visitors from foreign markets, lowers barriers to participation. An agency network coordinates cross-region itineraries, ensuring offers are situated where demand is strongest and reaching new outbound segments.

Marketing emphasizes a positive, welcoming France brand in outbound campaigns, highlighting luxury options alongside accessible camping experiences. Programs are marked by open collaboration with regional tourism boards and agency partners. A little national budget supports co-branding with partners in portugal ve switzerland, promoting longer stays and cross-sell experiences.

Measurement focuses on level indicators: average length of stay, occupancy, and revenue per visitor, tracked through a shared data platform. Monthly reports show upward trends and help identify where visits can be extended. If demand drops in certain periods, the program includes flexible offers such as a temporary boost in free nights to smooth volumes after holidays, keeping the experience welcoming and accessible.

Building Luxury Experiences: From Private Access to Bespoke Itineraries

Provide private access to exclusive venues and craft bespoke itineraries that fit guests’ schedules, pairing private island dinners, after-hours museum openings, and private guides with seamless transport. Such configurations start from a core set of assets and scale with demand.

Forecasts show a nine percent increase annually in luxury tourism spend worldwide, with abroad and overseas markets driving growth. Anglophone travelers spent more per trip, and such segments value private guides and seamless logistics.

To scale, design nine core experiences that can be customized across destinations: private access to coveted venues, intimate culinary events, wellness retreats, cultural tours, design-led shopping, heritage journeys, adventure days, and island escapes. Price the packages to reflect different levels of exclusivity, delivering impressive levels of personalization and ensuring the same high standard across all touchpoints.

Markets such as greece, germany, liechtenstein show strong outbound demand. External partners help release two new itineraries each half-year, diversifying options while maintaining exclusivity.

Since the program started, operators can track performance via a simple dashboard that links tourist spent by each client to feedback. The dashboard should reference industrys benchmarks to gauge satisfaction, adjust offerings, and forecasts for next quarter across inbound and overseas corridors.

This approach increases the value of tourism, spreading demand more evenly, and supports sustainable growth while satisfying discerning travelers.

Overtourism Fears: Real‑Time Monitoring, Local Feedback, and Responsive Management

Recommendation: Implement a centralized real-time monitoring dashboard across France’s top destinations to track visits, occupancy, and sentiment, with automated alerts when a site nears capacity and a guide toward dispersing crowds. Prepare shoulder-season incentives that encourage a jump in autumn visits and manage winter flows without compromising sights and local life.

-

Real-time monitoring and data integration: Create feeds from entrance counts at sites, hotel occupancy data, transport usage, and domestic versus international arrivals. Use a heat map to visualize impacted sites and trigger alerts when visits exceed high‑pressure thresholds; auto‑suggest nearby alternatives to balance length of stay and avoid half‑length spikes in peak periods. Track metrics such as visits per site, average length, and occupancy depth to identify where pressure is highest and needs quick adjustments.

-

Local feedback loops and community engagement: Deploy on-site kiosks and short mobile surveys to capture crowding perception, satisfaction with experiences, and appetite for alternative routes, cuisines, and nearby sights. Feed weekly results into a guide for operators and municipal staff, enabling rapid adjustments to access controls, signage, and parking. Host quarterly town halls around major hubs to translate data into concrete, neighborhood‑level actions.

-

Responsive management actions and scenario planning: Use the data to shift opening hours, rotate ticketing, and promote less‑visited sights in the same region. Expand domestic offerings and culinary routes to spread demand across development corridors around France, linking sights with infrastructure upgrades. Prepare multiple scenarios for autumn, winter, and spring to respond to projections and potential impacts on the market and broader recovery.

-

Transparency, communications, and international context: Publish concise summaries that compare trends while also presenting comparing viewpoints across markets, including Asia and other worldwide regions, and clearly show how opened sites and new infrastructure support recovery. Highlight promising indicators such as reduced concentration at peak hours and higher satisfaction ratings, while noting areas needing adjustments. Use a straightforward site map that guides visitors toward alternative sights and around congested districts to maintain a high‑quality experience.

Spreading Footfall: Seasonal Shifts and Regional Diversification Across the Country

Launch a three-region shoulder-season pilot funded by the council and local partners; target spring and autumn windows, with three destinations to test demand patterns. Choose either coastal, alpine, and inland towns to diversify seasonal appeal. Build a wordpress hub with authentic stories, itineraries, and booking links, updated weekly from resident and visitor feedback. A dedicated working group coordinates the pilot and engages local contributors in content creation and data collection to sharpen insights.

Signs show demand shifting from single hotspots toward regional gateways; during shoulder seasons, occupancy rose in pilot destinations and visitor spending increased accordingly. This approach necessarily requires close coordination with local partners. Spending on regional campaigns should rise by an additional 15-20% in the next cycle to sustain momentum, with a focus on experiences that appeal to european and international audiences, getting travelers internationally and staying longer in multi-destination itineraries. Destination diversity is essential for sustained demand, and councils should track which destinations perform best during each window.

Contributors from hospitality, heritage, and transport supply practical insights; a dedicated wordpress-powered stream coordinates promotions and publishes case studies from the field. In frances, regional authorities tested weekend escapes linked to switzerland and other european destinations to stimulate cross-border travel. A council-backed plan ensures data collection from shops, guides, and operators, feeding insights into the central dashboard.

Destinations across europe show that pairing nature and culture reduces peak-season pressure; a rise in multi-destination itineraries is driven by rail and bus links that connect alpine towns with coastal routes. Switzerland partners help broaden the portfolio with winter and summer combos, creating longer stays and balanced crowd levels. Predicted shifts in traveler behavior support this approach. Still, the potential for regional diversification remains clear. We expect a measurable uptick in average stay across test routes. Each destination remains a base for cross-border packages.

Next steps for councils and regional boards: align with tourism teams, update risk dashboards, and ensure sustainable yields. Identify three to five opportunities across the country for 2025, and monitor signs of demand growth during each season. Publicly share results on wordpress to demonstrate progress and invite local contributors to refine itineraries, product, and pricing in real time. The plan is driven by data, backed by funding, and designed to benefit frances and its european destinations, while remaining attractive internationally. Funding is provided to back this effort.

Global Tourism 2023: What the Numbers Mean for France’s Strategy

Recommendation: Take this approach now: France must target longer stays and premium experiences, guided by the Global Tourism 2023 report.

The 2023 data shows a robust rebound in international tourism, with european markets showing the strongest pull. The report highlights that the greatest gains came from european travelers, while spain and belgium recorded higher per-visitor spending. Weekend getaways rose sharply, and midweek stays showed an increase, signaling demand for flexible itineraries. This pattern supports a shift toward multi-night stays in regional hubs and rural towns. promising insights from these trends underscore opportunities for France.

In France, leveraging rail connections to link major cities with small towns will boost cross-regional visits. An invested rail network can reduce transport friction for day and weekend trips, translating into more spending per trip and longer stays. The spending profile with premium accommodations and cultural experiences is especially beneficial in shoulder seasons, bringing more value with relatively small incremental costs. Public subsidies, spent by national and regional bodies, accelerate this upgrade.

Looking at peers, a positive last-year performance from countries such as spain and belgium suggests that cross-border promotions and joint marketing can expand the tourist pool. turkey also shows rising inbound interest in European leisure routes during spring and autumn weeks. Expert analysis suggests that your team should look further at these markets and tailor packages that combine rail passes, weekend breaks, and heritage experiences to capture a broader audience, during shoulder seasons.

What to do next: pilot cross-border rail passes and weekend bundles with flexible booking; promote multi-city itineraries that include rural French areas; align pricing with seasonal demand to sustain growth; measure total tourism impact by tracking stay length, number of visits, and per-visitor spending to refine the forecast. The report suggests that these steps will increase average stay duration and drive a more even distribution across the year, bringing positive outcomes for your regional partners and the wider european market.

Tracking Progress: KPIs, Dashboards, and Transparent Public Reporting

Implement a centralized KPI dashboard that tracks visited, short-stay, destinations, overtourism indicators, and revenues across national and overseas markets, then publish quarterly public reports on a dedicated site.

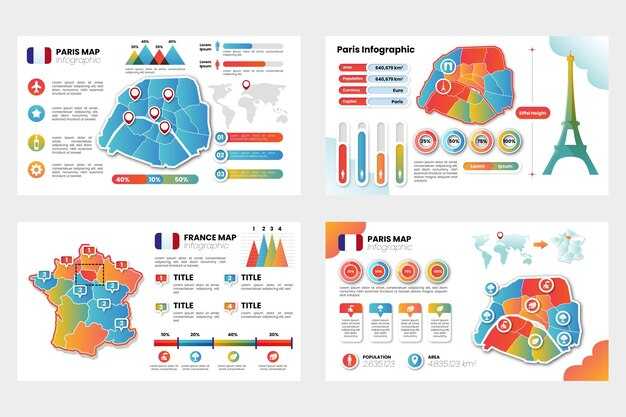

Define a concise set of indicators with precise definitions to allow Members to compare performance across time. Include visited destinations and their length of stay, the share of short-stay bookings, and trends in overtourism indicators. Track revenues per destination and budget utilization, and present forecasted trajectories alongside actual results. Use ranking to show which destinations are ranked by performance, highlight gains and declines, and maintain a time-series view that reflects history while projecting forward for summer peaks and other seasonal cycles. Tie the metrics to stated policy goals and show how much revenues around flagship destinations are generated, including overseas markets, to reassure stakeholders. Also present a trillion-euro potential if the plan delivers broad, steady gains, and indicate where visitor numbers declined in the latest period.

KPIs and dashboards

Design the dashboards with two layers: an executive view and a detailed data site. The executive view aggregates key numbers, shows performance against targets, and flags outliers. The data site hosts drill-downs on each destination, with booking volumes, visitor counts, and length-of-stay trends. Ensure a clear link between purpose and results, so readers understand why a metric matters and how it was achieved. Provide accessible charts, ranked tables, and a simple legend to explain terms, and publish history to illustrate progress over time.

Transparent reporting and governance

Establish an open reporting cadence managed by national tourism authorities and their Members, with regular updates on budget use, revenues, and forecasted scenarios. Publish a public annual report that explains methodology, data sources, and limitations, and include a short explanation of changes from the previous period. Create a glossary for terms like overtourism, booking, and visited to ensure consistency. Highlight the kingdom’s role in regional tourism and acknowledge data gaps or delays openly. By presenting numbers clearly and maintaining a neutral tone, the site builds trust and supports informed decision making across destinations, from local towns to overseas partners.

France’s Upgraded Tourism Strategy – Longer Stays and Luxury Experiences to Combat Overtourism Fears">

France’s Upgraded Tourism Strategy – Longer Stays and Luxury Experiences to Combat Overtourism Fears">

France Medieval Villages Road Trip – 18 Stops Through the Middle Ages">

France Medieval Villages Road Trip – 18 Stops Through the Middle Ages">

Travel in France – A Practical Guide to Sights, Food and Culture">

Travel in France – A Practical Guide to Sights, Food and Culture">

French Tourism Demand – Trends, Drivers, and Forecast for 2025">

French Tourism Demand – Trends, Drivers, and Forecast for 2025">

France Tourism Statistics – Visitor Numbers & Trends">

France Tourism Statistics – Visitor Numbers & Trends">

Unlocking Insights – Exploring the French Traveller">

Unlocking Insights – Exploring the French Traveller">

DMC in France – Expert Destination Management for Your Event">

DMC in France – Expert Destination Management for Your Event">

Paris'i Düşük Bütçeyle Ziyaret Edin – Fransa'da 10 Yıl Yaşamanın İpuçları">

Paris'i Düşük Bütçeyle Ziyaret Edin – Fransa'da 10 Yıl Yaşamanın İpuçları">

Paris 2025'te 50 Milyon Ziyaretçi Bekliyor – Turizm Görünümü">

Paris 2025'te 50 Milyon Ziyaretçi Bekliyor – Turizm Görünümü">

Fransa'da Turizm Endüstrisi – Eğilimler ve Ekonomik Etkiler – Araştırma Makalesi">

Fransa'da Turizm Endüstrisi – Eğilimler ve Ekonomik Etkiler – Araştırma Makalesi">

Fransa'ya Seyahat Etmeden Önce Bilmeniz Gereken Her Şey">

Fransa'ya Seyahat Etmeden Önce Bilmeniz Gereken Her Şey">