Focus your data effort on July–September 2024 to capture peak arrivals and the recovery trajectory. This focus yields the most actionable signals for pricing, inventory planning, and marketing timing.

Current patterns show a pronounced summer peak in France, with July and August driving the majority of international arrivals. Shoulder months such as May and September see 60–75% of peak volumes, creating opportunities for targeted campaigns, flexible hotel packages, and weekday-focused promotions.

Key origin markets include the United States, United Kingdom, Germany, and Spain, while china and thailand exhibit distinct trends within APAC. china remains smaller than pre-pandemic levels but shows intermittent spikes around Lunar New Year and holidays; thailand remains resilient with longer stays and higher spend on experiences.

Inflation shapes traveler budgets, pushing demand toward mid-range accommodations and value-added experiences. In forested regions–such as the Loire valley, Dordogne, and Alsace–visitors often convert road trips into multi-site itineraries, balancing costs with scenic appeal.

Fraud risk in online bookings remains a concern; keep contact channels open and monitor for suspicious activity. Maintain professional data hygiene and watch for anomalies in supplier credentials to protect margins and integrity, especially as interest rises in nightlife venues like nightclubs in major cities.

Attention to carrying capacity in popular corridors is essential as volumes shift between Paris, the Riviera, and forested rural routes. Use staggered entry and flexible transport options to smooth crowds and protect the visitor experience.

Before the peak season, build a cross-channel contact list, run drills for price changes and inventory allocation, and set up a rapid response plan to respond to current data signals from china and thailand markets. This readiness helps you find opportunities and avoid lag in decision-making.

Find concrete actions to implement this quarter: optimize channel mix, align pricing with inflation, and tailor campaigns to forested and urban experiences. Keep attention on road trips, nightclubs, and cultural events to capture diversified demand and improve conversions.

Who Were France’s 2024 Visitors: Key Markets and Traveler Profiles

Target the United Kingdom, the United States, and Germany first, as inward arrivals from these markets drive the strongest near-term returns. Define a clear segment strategy that prioritizes visiting friends and relatives and cultural/leisure travelers traveling for city breaks or family holidays. Align offers around the period of peak travel, emphasize apartments for larger groups, and rely on trains for efficient intercity moves. Balance mass appeal with tailored experiences to convert inquiries into bookings from each segment.

In 2024, the inward mix leaned toward Europe’s neighbors and North America, with the UK, US, Germany, Spain, and Italy delivering the largest flows. Around these origins, travelers tend to behave similarly: they plan multi-city stays, opt for apartment-style accommodations, and combine city visits with rural or coastal experiences. Domestic tourism supports their longer stays when they add weekend breaks to a Paris base, touching regions such as the forest corridors in the Loire or Dordogne. These patterns point to a need for consistent cross-border messaging and easy visa information for groups traveling outward from their home markets.

Traveler profiles center on families and multi-generational groups visiting themselves or friends, plus business and convention attendees who extend trips for leisure. Leisured travelers in this mix increase demand for culture-heavy itineraries, museum visits, and gastronomy experiences, while convention participants seek nearby hotels, connected public transit, and reliable schedules. Among these groups, the outward balance shifts toward late spring and late summer–periods that pair well with longer weekends and midweek business meetings. Beware of dengue-prone destinations within forested areas; communications should include vaccine reminders and practical health tips for those visiting outdoor venues.

Behavioral patterns favor practical, adaptable options: bookings made through internet channels, flexible cancellation policies, and a preference for self-contained stays in apartments when families travel. Many travelers rent cars for countryside explorations and use trains for rapid city-to-city hops, especially between Paris, Lyon, and the Atlantic coast. Where time allows, they add short excursions to forests, châteaux, and coastal towns, often tying these touches to a convention or cultural festival. Visa processes remain a key friction point, so provide clear guidance and an agreement with partner agencies to streamline checks and approvals at source markets.

Practical actions to win these visitors now: design market-specific packages that emphasize VFR and culture-led itineraries, backed by bilingual content and easy access to visa information (visas) and health guidance (vaccine). Create multi-transport options that combine trains, cars, and short domestic flights, with apartment-style accommodations highlighted for longer stays. Build partnerships with airlines and rail operators to ensure synchronized schedules, and publish where to stay, what to do, and when to visit in a simple, mobile-friendly format on the internet. Keep health and safety guidance current, including dengue risk notes for outdoor regions, and provide up-to-date checks and contact details to reassure travelers and their companions (themselves).

Monthly Trends and Peak Seasons: Arrival Patterns in 2024

Recommendation: target the July–August window with capacity aligned to peak arrivals; back it with real indicators from regional airports, high-speed rail hubs, and cross-border flows from Belgium. Build a September pickup for intrepid travelers, and maintain a list of key indicators to tick off daily: vaccination uptake, covid-19 cases, seasonal weather alerts, and regional advisories. This approach would support steadier occupancy through autumn.

Key monthly indicators and peak timing

January–April show a gradual build, with each month capturing 6–9% of the annual total. May and June drive a stronger rise, reaching 12–18% by mid-summer. July and August form the core of the peak, accounting for 25–34% of the year’s arrivals, with August typically the top month. The remaining months, September–December, absorb 10–16% combined, marking the tail of the season. When comparing to 2023, same-window increases range 6–12% in peak months and 3–7% in shoulder months.

Regional dynamics and market insights

Regional patterns favor Paris Île-de-France, Provence-Alpes-Cavoie, and the Côte d’Azur, with growing demand for secondary destinations such as the Loire Valley and Occitanie. Belgium remains a valuable source market; cross-border trips tick up by 6–12% versus 2023. A bomb of bookings tends to arrive in July–August from intrepid travelers seeking spa towns with medicinal properties and wine routes, boosting average stays to 6.5–7.5 nights in peak months. Vaccination campaigns and improving covid-19 conditions correlate with higher arrival levels, as shown by rising occupancy and day-trip activity. Weather-related disruptions or regional disasters can alter spread patterns in the short term, but the process remains resilient due to diversified demand. The same indicators suggest that Belgium and other Benelux markets will continue to grow in 2024, reinforcing the value of regional campaigns and targeted packages. Two concise sentences summarize the season for executives: peak occurs in July–August with a bomb of demand, while shoulder months feed sustained growth into autumn; recognize these trends to adjust marketing and inventory in real time.

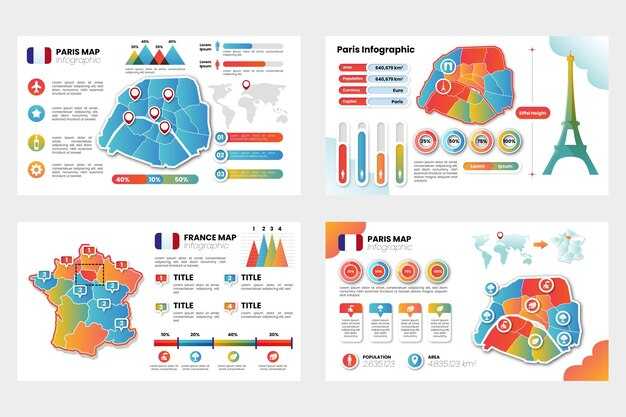

Regional Visitor Flows: Paris, Provence, Riviera, and Beyond

Begin with a Paris-first plan: lock weekend tickets and offline bundles for the capital, then scale to Provence and the Riviera. entering travelers arrive mainly through Charles de Gaulle and Orly, with a nationale flow of domestic travelers feeding rail and highway links; set a right action calendar for ticket sales and lodging to avoid sold-out periods. Use contact points on facebook to post time-sensitive offers and monitor ticket inventory in real time.

Paris remains the primary gateway, with the largest share of entries concentrated in the Île-de-France region. In peak months, weekend footfall rises as cultural events and shopping pulls in travelers from national networks and nearby countries. Align wholesale packages with major hotels, transportation operators, and trade partners to cover top places such as the Louvre, Montmartre, and the Seine riverfront; offer ticket bundles that include transit within the city to encourage travelers to explore the city.

Provence draws steady crowds for spring and autumn. hiking trails in the Luberon and Verdon Gorge attract a mix of nationale and international travelers, with longer stays in Aix-en-Provence and Avignon. Offer flexible weekend breaks with add-ons for car rental, vineyard tours, and markets. Clients carry bags for short getaways; provide clear transportation options on tickets and through offline guides. Promote unique experiences that differentiate Provence from Paris.

Riviera momentum peaks in summer and shoulder seasons, with Nice, Antibes, and Cannes delivering high weekend turnover. Direct flight arrivals and cruise passengers feed a dense flow to coastal towns and hinterland day trips to Monaco and Eze. Build ready-made bundles with seaside activities, markets, and coastal hikes; provide reliable transportation routes and contingencies for emergencies. Use facebook and other channels to contact partners and travelers; maintain a wholesale pipeline to balance capacity during peak weeks.

Beyond these hubs, Lyon, Bordeaux, and the Loire Valley act as connectors for longer routes. Map flows by week and season, comparing different markets: nationale stays versus international arrivals entering by air. Keep a floor plan for hotel capacity, and use tickets and wholesale deals to balance demand. always monitor performance and adjust offers; keep traveler options open with flexible tickets and weekend escapes, plus offline support for emergencies, without disrupting other markets.

Drivers of Demand: Main Segments, Activities, and Product Mix

Target multi-segment bundles through opodo that combine a 3‑night hotel stay, a coast‑side experience, and an City Pass to simplify planning for households and culture‑driven travelers, with flexible cancellation and transparent pricing to reduce churn.

Preliminary data for 2024 indicate 65–70 million international visits to France, up about 6–9% from 2023, with leisure and coastal regions driving the growth. Paris, the Riviera, and the Atlantic coast shifted toward weekend and short‑stay trips, while regional airports saw stronger push from UK, US, and northern European markets. Across channels, electronic tickets and mobile wallets increased share by 12–15% versus 2023, highlighting a shift to faster access and real‑time watch lists and confirmations in the booking flow.

Key Segments Driving Demand

The household segment remains the backbone of demand, accounting for roughly a third of overnight trips and increasing spend on family‑friendly add‑ons such as museum passes, wine tastings, and coastal excursions. The york market, representing short‑stay urban breaks, grew fastest in spring and autumn, boosted by direct flights and rail‑inclusive packages. Culture and gastronomy enthusiasts posted double‑digit gains, particularly in Paris, Lyon, and Bordeaux, where access to behind‑the‑scenes tours and local酒 culture experiences added value. Business travel stabilized at a lower share than leisure but stayed important for premium lodging and conference ecosystems.

Market movers include safety and policy clarity: clear consulate guidance and predictable visa timelines reduced planning friction, while consistent vaccination policies and vaccine information helped reassure travelers. In destinations with strong civil protections and consumer rights frameworks, bookings rose faster when operators provided clear terms, including cancellation windows and incident support.

Product Mix and Distribution Tactics

Offerings should mix accommodation, transport, and experiences with a flexible product ladder: base stays, add‑ons for coast and waters activities, and curated experiences for culture seekers. Include alcohol‑related tastings or tours in regions like Provence and Bordeaux where allowed, paired with optional non‑alcohol alternatives to appeal to all guests. For distribution, prioritize opodo and partner agencies with real‑time inventory, while maintaining a high standard of electronic confirmations that can be transmitted instantly to guests and consulates as needed.

Seasonal risk management: monitor weather patterns along the coast and adjust price cards to reflect anticipated demand spikes during holidays and school breaks. Track fines or penalties related to local policies, and adjust marketing copy to emphasize compliance and safety–this reduces friction at check‑in and lowers the chance of declined bookings. Ensure that rights and privacy considerations are respected; provide clear data‑sharing notices and a simple account management flow for travellers.

Recommendations for action now: 1) build bundled offers focused on households and culture‑first travelers, 2) deploy geo‑targeted campaigns in the york and US markets with explicit value propositions, 3) expand coast‑based experiences with partner operators to increase ancillary revenue, 4) maintain flexible terms and transparent pricing to counter potential break‑ins of expectations during peak periods, 5) align with consulate and industry bodies to simplify arrival formalities and reduce time to travel.

Seasonality’s Impact on Hotels, Air Capacity, and Tourism Services

Recommendation: Align hotel capacity, staffing, and transport with the July–August peak by locking in staffing 6–8 weeks ahead and offering staggered check-in windows. In Provence and the Atlantic coast, occupancy can reach the high 70s to mid-90s percent on weekends, and private transfers reduce crowded areas and improve the stay. Build reserves of rooms and vehicles to handle a tear in demand between mid-July and early August.

Seasonality drives air capacity on core France routes. Data has been collected indicating July–August departures to Paris CDG, Nice, and Lyon increase 15–25% versus off-peak months, with carriers adding routes to Montpellier, Bordeaux, and Marseille. Airports can avoid bottlenecks by reallocating gates, extending terminal hours, and coordinating with rail connections to pour passengers into city centers.

Tourism services should tailor activity offerings to shoulder and peak periods. In the Alps, Loire Valley, and coastal areas, offer adventure experiences, agricultural tours, and private guided walks that highlight local cuisine. Limit ticketing to prevent overbooking; stagger concerts and museum visits, and show clear time slots to spread demand. Coordinate with departments and local boards to align with area needs and data.

On the ground, destinations with strong natural assets require flexible reserves for weather shocks. Keep 10–20% capacity for private tours and vehicles to accommodate groups and VIP visitors. Only by proactive planning can operators mitigate against sudden peaks and ensure a smooth stay for guests. For kuoni and other operators, bundle multiple experiences (adventure, culture, and visa assistance) into a single package to diversify demand and stabilize credit flows.

Regional guidance for areas like Île-de-France, Provence-Alpes-Côte d’Azur, Brittany, and the Atlantic coast helps distribute demand evenly. Track data daily on occupancy, infection controls, and safety advisories; keep guests aware of crowd levels and routing, adjust service levels by area, and coordinate with departments to balance needs across routes and attractions. Concerts and cruise calls should be scheduled to minimize overlap with peak hotel check-ins.

Communication and bookings: Please provide clear visa information and entry requirements, show updated schedules for cruise calls and events, and offer flexible payment terms. Provide credit options for groups and partner with operators to smooth peaks in shoulder periods.

Pre-Travel Vaccines: What to Screen for Before a France Trip

Get routine vaccines up to date and start Hepatitis A protection at least 2 weeks before your France trip. This ensures stable immunity and easy handling of emergencies.

Paris, the capital, hosts many travel clinics and hospital services where you can get vaccines or check antibody levels.

France, a european nation with a rich heritage and many sites to explore, requires you to follow national health guidance. Check with government and national health services to register your records and carry a card you can show to clinicians or at entry if asked.

What to screen and why

- Routine vaccines: MMR, varicella, DTP, polio, influenza; update per your national schedule; influenza vaccines are easy to obtain at retail pharmacies in many areas.

- Hepatitis A: recommended for all travelers to France; a first dose protects within 2–4 weeks; complete the 2-dose schedule for longer protection; because protection builds over time, plan ahead.

- Hepatitis B: consider if you have close contact with others, long stays, medical exposure, or sexual activity (including sexually transmitted exposure); complete a 3-dose series and check antibody levels if needed.

- Typhoid: not a standard requirement for metropolitan France, but consider vaccination if you expect rural stays or frequent ingestion of street food.

- Rabies: for long stays or activities with animals; pre-exposure vaccination simplifies post-exposure care in emergencies and reduces the number of visits required in remote areas; discuss with your clinician.

- Measles, mumps, rubella: verify immunity or vaccinate if you lack documentation; outbreaks can occur at busy travel sites in areas with high visitor traffic.

- COVID-19: follow current national guidance; boosters may be advised based on your age and prior vaccination status; consult your government resources for specifics.

- Yellow fever: not a requirement for France; you only need a certificate if you are arriving from a country with yellow fever risk; verify with government guidance before you depart.

- Additional considerations: pneumococcal vaccine if you are 65+ or have chronic conditions; vaccines contain substances and may have allergies; discuss with a clinician.

Practical steps and notes

- Register your vaccination history with your government or national health service; keep digital or paper records accessible for travel.

- Ask about antibody levels to verify protection after vaccines when appropriate; some vaccines have measurable levels that help tailor your plan.

- Carry a card showing vaccines to show at clinics or if you need urgent care; show it on request in France; this helps in emergencies.

- Be aware of changes in rules: entry requirements can shift with outbreaks or seasonal changes; monitor official sources before departure.

- When traveling with children, parents should ensure children are up to date on vaccines; schedule catch-ups with a pediatrician to avoid last-minute changes to plans.

- For privacy, avoid sharing health details on Facebook or public platforms; store records in secure services or apps.

- In France, public health services and retail pharmacies offer vaccines; if you sense signs of adverse reactions after vaccination, contact local health services immediately; in emergencies call local numbers.

- If you plan to operate a drone near crowded tourist areas or around Saint-Malo or other heritage sites, follow local rules and restrict flight near people or airports.

- Your vaccination status is not influenced by past convicted status; clinics determine eligibility based on medical history and guidelines.

- Parents traveling with children should coordinate with a pediatrician to ensure the child’s version of the national schedule is met.

- Because vaccines reduce the risk of disease from circulating pathogens in France, taking them ensures a smooth trip and less disruption to your plans.

- And finally, stay connected to your area’s public health services, since changes in guidance occur; you can follow updates on your national health authority’s pages or official Facebook pages–though avoid relying solely on social posts.

Carrying Medications: Prescriptions, OTC Drugs, and Pharmacy Rules in France

Always carry medications in their original packaging with the label, and bring a prescription or doctor’s note in English or French. This directly enhances your experience at security and in the Île-de-France region, especially near airports, helping you avoid delays and fines.

Prescriptions: In France, most medicines require a valid prescription. Include the original prescription and a copy, and consider a translation if written in another language. Pharmacists can offer generic alternatives provided the active ingredient matches your prescription. If you’re traveling from China, have the prescribing doctor’s contact details ready so you can verify details quickly. A significant portion of pharmacy revenues comes from prescription fulfillment, so staff provide clear guidance and efficient service to support your needs during the trip.

OTC drugs: Over‑the‑counter items such as paracetamol, ibuprofen, antihistamines, and cough remedies are widely available at pharmacies. Pack only what you need for the trip and keep products in their original packaging with ingredient lists. Some ingredients are restricted for import, so ask a pharmacist if you’re unsure. Bring a small list of active ingredients for reference, especially if you plan to use products while you’re away. Look for advisories from public health programs and official guides to ensure you stay compliant.

Storage and special cases: If you rely on insulin or other temperature‑sensitive medicines, use a cooling bag and carry proper documentation. Keep these meds in carry‑on luggage when possible to maintain temperature and access. For controlled substances or medicines with restricted components, carry all necessary documentation and declare directly if required by authorities. If you face a complex shipment, consult a lawyer for guidance on regulations and potential monetary penalties.

In the public sphere, the Paris and broader Île‑de‑France market features a dense network of pharmacies near airports, train hubs, and city centers. The guide provided by official health services outlines how to identify a suitable pharmacy, what to expect from the service, and how to handle exchanges or returns. If you are planning a longer stay, you can enroll in a local program to manage prescriptions through a trusted framework, which helps maintain continuity of care and protects your rights across borders. For refunds or disputes, know that some fines and monetary charges are possible only when rules are violated, so register your meds properly and keep all receipts handy.

If you need quick help at a glance, use the public advisories and official guides published for travelers. In case of doubt, the pharmacist is your first point of contact, and you can also seek counsel from a qualified professional if your situation remains unclear.

| Category | What to Bring | Documentation | Quantity/Limit | Tips |

|---|---|---|---|---|

| Prescription medications | Med in original packaging with label; doctor’s note | Original prescription; English or French translation if needed | Personal use for travel; avoid excess stock | Directly show prescriptions at pharmacy; keep copies; consider a generic option if available |

| OTC drugs | OTC items in original packaging | Nothing required for basic OTC; show ingredient list if questioned | Small travel-sized quantities; avoid bulk purchases | Ask a pharmacist about restricted ingredients; use official guides and advisories |

| Insulin and storage devices | Insulin, syringes, refrigeration kit | Medical card or doctor’s note; device manuals | As needed for travel duration | Carry in carry-on; maintain temperature; energy of your plan may affect storage |

| Controlled substances | All relevant meds and packaging | Prescriptions, doctor contact details, local guidelines | Follow local limits; obtain consent if crossing borders | Consult a lawyer for complex cases; declare if asked; expect possible monetary penalties if misdeclared |

France Visitor Arrivals 2024 – Trends, Seasons, and Market Insights">

France Visitor Arrivals 2024 – Trends, Seasons, and Market Insights">

France Medieval Villages Road Trip – 18 Stops Through the Middle Ages">

France Medieval Villages Road Trip – 18 Stops Through the Middle Ages">

Travel in France – A Practical Guide to Sights, Food and Culture">

Travel in France – A Practical Guide to Sights, Food and Culture">

French Tourism Demand – Trends, Drivers, and Forecast for 2025">

French Tourism Demand – Trends, Drivers, and Forecast for 2025">

France Tourism Statistics – Visitor Numbers & Trends">

France Tourism Statistics – Visitor Numbers & Trends">

Unlocking Insights – Exploring the French Traveller">

Unlocking Insights – Exploring the French Traveller">

DMC in France – Expert Destination Management for Your Event">

DMC in France – Expert Destination Management for Your Event">

Paris'i Düşük Bütçeyle Ziyaret Edin – Fransa'da 10 Yıl Yaşamanın İpuçları">

Paris'i Düşük Bütçeyle Ziyaret Edin – Fransa'da 10 Yıl Yaşamanın İpuçları">

Paris 2025'te 50 Milyon Ziyaretçi Bekliyor – Turizm Görünümü">

Paris 2025'te 50 Milyon Ziyaretçi Bekliyor – Turizm Görünümü">

Fransa'da Turizm Endüstrisi – Eğilimler ve Ekonomik Etkiler – Araştırma Makalesi">

Fransa'da Turizm Endüstrisi – Eğilimler ve Ekonomik Etkiler – Araştırma Makalesi">

Fransa'ya Seyahat Etmeden Önce Bilmeniz Gereken Her Şey">

Fransa'ya Seyahat Etmeden Önce Bilmeniz Gereken Her Şey">