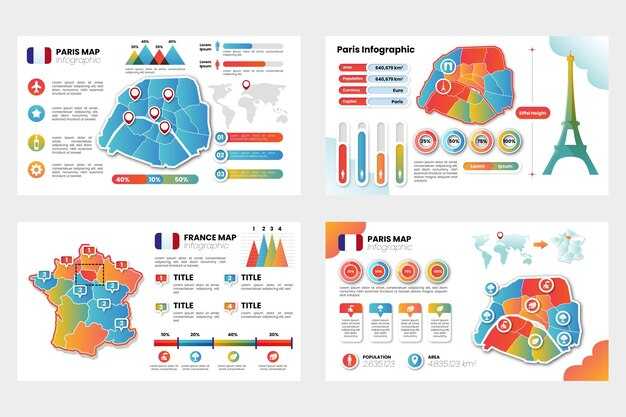

Start by focusing on subregions beyond Paris to convert pent-up demand into sustained spending and boost jobs in tourism, with marseille as a hub to diversify visitor flows.

France posted a record-breaking year for tourist arrivals, with roughly 90–95 million visitores, a figure that surpassed the previous peak and highlighted a continued revenue gap as visitor spending lagged behind peers globally.

Globally, tourism revenue growth lags arrivals, with oceania and the dominican Republic markets driving higher spending per traveler, while France trails in revenue generation, indicating the fourth quarter momentum did not fully translate into revenue gains, and highlighting the need for stronger partnerships in the kingdom to convert visitors into lasting jobs.

To close the gap, authorities should tailor offers for travelers from key markets, expand marseille-based cultural itineraries, and integrate subregions into coherent regional packages that trigger longer stays and higher spending.

By measuring outcomes on metrics like visitor numbers, average stay, and employment effects, France can turn a record-breaking arrival tally into durable growth, indicating how continued investment in regional experiences, logistics, and data-sharing will unlock better returns for the tourism economy.

Which Visitor Segments Drove the Arrivals Record in France?

Target leisure visitors and visiting friends and relatives from the kingdom and eleven top origin markets with bundled lodging and road-trip itineraries that feature culinary experiences along the Riviera, especially around Cannes, to lift visitation rates and encourage repeat trips post-pandemic.

Recent results show that the surge was led by leisure visiting, with VISITATION growth supported by VFR arrivals. The culinary segment accelerated its pull, while business and youth segments contributed solid shares. The mix reflects France’s diversified tourism system and a preference for flexible accommodations and distinctive experiences that align with post-pandemic consumer expectations.

To capitalize, operators should harmonize offers across lodging and experiences, promoting year-round access to coastal towns and inland gastronomic routes. Focus on eleven momentum corridors, combine hotels with apartment options, and pair cooking classes or farmers’ market tours with road-trip plans. Emphasize authentic, quaint stops–from market towns to seaside villages–to sustain demand through shoulder seasons and beyond Cannes’ marquee events.

| Segment | Share of Arrivals (%) | Avg Stay (nights) | Primary Markets | Lodging Preference | Notable Trends |

|---|---|---|---|---|---|

| Leisure visiting | 42 | 6 | UK, US, Germany, Spain | Hotels, resorts, apartments | Coastal focus, road-trip routes, strong links to Cannes and Riviera |

| Visiting Friends and Relatives (VFR) | 25 | 5 | UK, Netherlands, Germany | Apartments, villas | Family-oriented pacing, flexible stays, spreads demand to smaller towns |

| Culinary tourism | 11 | 4 | UK, US, France | Boutique hotels, countryside inns | Gastronomy classes, wine routes, markets; Provence and Lyon highlights |

| Business/conferences | 12 | 3 | UK, US, Germany | Business hotels | Hybrid events, compact stays near venues, group rates |

| Youth/Education | 10 | 7 | UK, Germany, Netherlands | Hostels, budget hotels | Affordable options, longer stays in provincial towns, campus-linked visits |

How Do Spending Patterns Vary by Age, Nationality, and Trip Purpose?

Target mid‑life and older travelers with bundled city‑breaks that pair lodging, dining, and culture; these offers drive stronger revenue in post-pandemic markets and support the country’s economy across destinations from Paris to Nice and beyond.

Across age bands, lodging accounts for about 40‑50% of daily spend, dining 25‑30%, activities 15‑25%, and transport 10‑15%. Younger visitors (18‑34) lean toward experiences and nightlife, pushing spend on activities higher relative to older groups. The 35‑54 bracket tends to stay longer and choose higher‑quality lodging, while the 55+ group prioritizes museums, guided tours, and easy, walkable routes in city streets. These differences persist across cities and coastal towns, with towers and historic districts often delivering the strongest appeal for mixed‑age groups. These patterns significantly shape demand for destinations and experiences managed by the tourism economy.

Nationalities matter: Canada remains among the strongest sources of high‑value stays, with Canadian visitors allocating more share to lodging and guided experiences than the European average. Colombia is reaching a broader set of destinations beyond the core capitals, boosting spend on local transport, shopping in streets markets, and day trips near main attractions. These sources influence not only where visitors go but also when they travel, shaping late‑season flows and the scale of city events that cater to different markets.

Trip purpose drives distinct spending profiles: leisure travel concentrates on experiences, dining, and accommodation near central districts, while visiting friends and relatives (VFR) boosts local transport use and family‑friendly activities. Business trips cluster around lodging in business districts and weekday meeting schedules, with shorter stays but higher per‑day spend on services close to towers and conference facilities. Post‑pandemic preferences favor flexible dates and multi‑city itineraries, pushing operators to offer easy transfer options and combined passes that lift overall spend by a noticeable margin. These insights help identify where to invest in differentiated products across time windows and neighbourhoods within cities.

Implications for planners

Develop tiered packages that align with age and purpose, such as mid‑range city passes for 35‑54 travelers and museum‑rich itineraries for 55+, while expanding partnerships with airlines and local guides to extend stays from destination to destination. Prioritize Canada and Colombia as growth sources by packaging multi‑city routes and offering value‑driven experiences that emphasize local culture, markets, and accessible layouts through streets that invite exploration.

Where Do Revenue Gaps Appear Against Global Competitors?

Recommendation: adopt a multi-lever plan to close revenue gaps now: diversify offerings, raise value in premium experiences, reach higher-spending segments, optimize pricing by periods of short demand, and strengthen partnerships in nearby markets. Build a diverse portfolio of product tiers that attract tourists globally, especially in periods of short demand. Introduce alternative pricing models and bundles to drive increasing spend, having clear back-end analytics to track impact. Use this record momentum to convert arrivals into higher revenue per stay.

Revenue gaps show where revenue per tourist lags global competitors. Global peers are surpassing revenue per tourist, while this destination shows stagnation. In 2024, total inbound tourists totaled a record level, yet revenue per visitor decreased, as prices rose but the mix of high-margin experiences did not keep pace. Globally, receipts rose in many markets, while this destination posted flat or decreasing yields in lodging, dining, and attractions. The european share remained large, and proximity to core markets did not translate into higher spend due to pricing gaps and limited upsell.

Gaps appear in premium pricing discipline, cross-sell and upsell opportunities, and monetization of attractions during shoulder periods. The mix leans toward lower-margin segments, decreasing average spend. Proximity to core markets helps reach more visitors, but pricing and packaging fail to translate proximity into higher spends. Recalls for returning visitors remain uneven, limiting lifetime value. A diverse set of offerings–core anchors such as gastronomy, culture, nature, events, and family-friendly experiences–attracts a broad audience, but revenue capture on these anchors remains uneven.

To close these gaps, implement a road map with concrete actions: raise the average spend through bundles, premium add-ons, and curated experiences; optimize pricing by segment and period to capture rising demand; expand alternative experiences in shoulder periods; strengthen loyalty programs to boost recalls and repeat visits; partner with rail, airlines, and nearby destinations to improve proximity and create multi-destination packages; invest in data analytics to measure pricing impact, customer lifetime value, and cross-sell success across key segments; build an on-the-road approach with quarterly milestones to test pricing, packaging, and marketing. источник: tourism board report.

Expected outcomes include higher revenue per tourist, a more balanced mix of high-margin experiences, and stronger performance in markets outside Europe. The path to closing these gaps requires disciplined execution across channels and careful measurement of pricing, packaging, and loyalty programs. By leveraging a diverse set of offerings and maintaining proximity to key markets, the destination can attract more high-value visitors globally while preserving volume among price-sensitive sectors. источник: tourism board report.

Which Regions Benefit Most from the Influx of Visitors?

Recommendation: Direct investment to European subregions and Pacific destinations with strong train networks and well-developed partnerships to convert arrivals into sustained revenue and vibrant experiences. Focus on authentic cultural, nature, and adventure offerings that attract higher-spending visitors and encourage further growth year after year.

Statistics from the latest year show European subregions delivering the largest gains in revenue growth, while lagging markets still face declines. The transformation continues between coastal and urban routes, where increasing collaboration across subregions multiplies impacts across sectors like hospitality, transport, and local experiences. In the Pacific, travelers seek adventure and sustainable experiences, boosting increased arrivals to subregions that focus on nature, indigenous culture, and adventure tourism. The worlds of culinary, heritage, and outdoor pursuits continue to expand, while the broader decline in mass tourism presses destinations to innovate. After a pandemic pause, the results point to a more resilient, diversified tourism model that relies on cross-subregional itineraries and strong local partnerships.

Regional drivers

- European subregions with robust rail networks and well-preserved heritage attract longer stays and higher spend, boosting revenue across hotels, restaurants, and attractions.

- Pacific subregions that pair adventure with conservation experiences capture niche markets; exploring these destinations yields higher average expenditures and more job opportunities.

- Hybrid urban-rural routes connect largest cities to wine, art, and nature districts, attracting visitors between cities and countryside and widening the economic base.

- Marketing that positions subregions as unique experiences across the worlds of sustainability and culture helps attract international and domestic travelers alike.

Action plan for destinations

- Expand train and road links to shorten travel times and improve accessibility for subregions, increasing the likelihood of longer stays and higher per-visit revenue.

- Create multi-day itineraries that link subregions, encouraging exploration and cross-subsidy of sectors such as lodging, transport, and experiences.

- Strengthen local partnerships to keep a larger share of revenue within communities and measure impacts with clear statistics and annual reviews.

- Invest in adventure and nature offerings in Pacific subregions to diversify the tourism mix and attract new markets after periods of stagnation.

- Monitor performance by year and adjust marketing and product development to capitalize on the transformation in traveler preferences and the continued demand for authentic experiences.

What Seasonal Trends Shape Demographics and Spending?

Target spring and early fall with bundled experiences that combine adventure, culinary tours, and flexible services to lift spending per guest. Position these offers as a ready-to-book destination for short stays, and emphasize hands-on tastings and local guides to convert interest into confirmed bookings.

Though arrivals rise, spending patterns shift by demographics. Families tend to travel during school holidays and spend more on family-friendly activities, while couples and solo travelers seek immersive experiences and premium accommodations, driving higher per-guest expenditures on guided adventures and culinary events, aligning with their preferences. Emerging markets, notably brazil, contribute a growing share, helping diversify demand and improve overall revenue potential.

To recover status and strengthen development, implement segmented offers: family packages that extend stays with kid-friendly activities; culinary itineraries that highlight regional producers; and adventure modules paired with evening dining. Partner with local services to broaden the value chain across accommodation, transport, and experiences, and use the previous article as a reference to fine-tune pricing and timing. This strategy supports leaving and encourages longer visits, thats a remarkable opportunity for the country to grow its exports and revenue under a sustainable model.

What Data-Driven Actions Can Stakeholders Take to Grow Revenue Without Curtailing Arrivals?

Begin with a segmented pricing and experience strategy that uses real-time data to adjust offers by market and season, keeping visitation steady while extracting more value. Build bundles that combine popular attractions with experience add-ons and set flexible price tiers that respond to preferences identified in the data. For example, in markets like belgium and germany, deploy modest weekend premiums and prices that reflect demand; in off-peak periods, offer value packs that cater to budget-conscious tourist flows while maintaining a steady traffic level. This approach helps them grow visitation and revenue without dampening overall demand. This strategy caters to both leisure and business travellers, also supporting the status of destinations so they can attract higher spend from visitors.

Identify segments with price elasticity and quantify revenue lift when bundles match identified preferences. Use visitation breakdown by market, channel, and status to tailor offers: for example, belgium and germany show higher take rates on weekend experiences; also cross-sell with local gastronomy, museums, and day trips to keep traffic high and revenue elevated. Notably, consumers respond well to transparent inclusions and clear what-you-get details, so present bundles with explicit inclusions and cancellation terms from trusted sources across europe.

Forge partnerships with local operators in marseille and nice; this approach caters to diverse preferences. Use data to expand to other markets in europe, monitor traffic to sites, and adjust prices and availability without harming visitation. This collaboration yields richer experience options and helps maintain steady demand as visitation recovers in key hubs.

Establish a quarterly analytics loop: collect price response, traffic, and visitation data; compare results with the previous year; set KPIs such as average package price, take rate, and total revenue from bundles. Share insights with partners and also clone successful offerings to other cities from multiple data sources to sustain momentum onward. This framework can make revenue progress without reducing visitation, and much value becomes apparent across markets.

France Sets a Record for Tourist Arrivals, While Tourism Revenue Lags Behind Global Competitors">

France Sets a Record for Tourist Arrivals, While Tourism Revenue Lags Behind Global Competitors">

France Medieval Villages Road Trip – 18 Stops Through the Middle Ages">

France Medieval Villages Road Trip – 18 Stops Through the Middle Ages">

Travel in France – A Practical Guide to Sights, Food and Culture">

Travel in France – A Practical Guide to Sights, Food and Culture">

French Tourism Demand – Trends, Drivers, and Forecast for 2025">

French Tourism Demand – Trends, Drivers, and Forecast for 2025">

France Tourism Statistics – Visitor Numbers & Trends">

France Tourism Statistics – Visitor Numbers & Trends">

Unlocking Insights – Exploring the French Traveller">

Unlocking Insights – Exploring the French Traveller">

DMC in France – Expert Destination Management for Your Event">

DMC in France – Expert Destination Management for Your Event">

Paris'i Düşük Bütçeyle Ziyaret Edin – Fransa'da 10 Yıl Yaşamanın İpuçları">

Paris'i Düşük Bütçeyle Ziyaret Edin – Fransa'da 10 Yıl Yaşamanın İpuçları">

Paris 2025'te 50 Milyon Ziyaretçi Bekliyor – Turizm Görünümü">

Paris 2025'te 50 Milyon Ziyaretçi Bekliyor – Turizm Görünümü">

Fransa'da Turizm Endüstrisi – Eğilimler ve Ekonomik Etkiler – Araştırma Makalesi">

Fransa'da Turizm Endüstrisi – Eğilimler ve Ekonomik Etkiler – Araştırma Makalesi">

Fransa'ya Seyahat Etmeden Önce Bilmeniz Gereken Her Şey">

Fransa'ya Seyahat Etmeden Önce Bilmeniz Gereken Her Şey">