Target properties in provence-alpes-côte markets where yields rise; start with a clear buying plan and evaluate a compact array of towns with strong occupancy, perhaps focusing on sea-view options. If you are interested in coastal markets, this approach keeps your focus sharp and reduces risk.

In 2025, the average price per square meter in coastal towns spans roughly €6,000 to €12,000, with premium spots at €12,000–€25,000. Long-term yields hover at 3.5–5.5% gross; short-term rentals can reach 4–8% gross depending on location and management. Expect occupancy for long-term stays in the 60–75% band, while tourist rentals may hit 70–90% during peak months.

educational insights come from comparing two market layers: professional rentals on the coast (rental stability) and speculative purchases in rising neighborhoods of the provence-alpes-côte. Consider property characteristics: sea view, terrace, parking, and stone façades – these features sustain demand and help command higher rents. In markets with stone architecture and heritage charm, maintenance costs may be higher but attract higher yields.

For interested buyers, the plan should include demographic and seasonality checks, and a financing strategy with stress tests for rate rises. Anticipate that mortgage rates around 3–4% may apply; align debt service with cash flow projections. Use an educational mindset to compare investment cases across at least five towns, focusing on living characteristics and local regulations for short-term rentals.

Finally, practical steps: map the array of neighborhoods with high tourist demand, run a 5-year cash flow, and build a small portfolio with 2-3 targeted properties. If you plan to hold long-term, prioritize stable rentals and ownership costs; if you chase yields, consider professional management to optimize occupancy and compliance. Perhaps start with a pilot in a stone-built property in a high-demand spot and scale from there.

11 Key Stats for the French Riviera Property Market in 2025: Festivals and Events

Target festival-driven demand by prioritizing properties near hotspots along the coast and align showings with December event calendars to boost commissions and please clients.

- In Cannes, Nice, and Antibes, occupancy during major festival weeks averages around 90–92%, with nightly rates 8–12% higher than the off-season baseline.

- Coast-wide property prices in 2025 rise roughly 6–9% in the provence-alpes-côte region, with sea-view terraces commanding premiums up to 12% higher than inland equivalents.

- The share of listings featuring terraces or sea views increases to about 68% across coastal locations, a shift that makes such homes more attractive to wealth-focused buyers and highlights tree-lined terraces.

- Average commission on festival-driven deals remains steady at about 4.5%, while December waves push top agencies to close more transactions with clients from abroad.

- Client hours spent viewing properties extend during event weeks; average showing hours climb by roughly 25% as buyers seek private tours and flexible scheduling.

- Hotspots along the coast–Cannes, Nice, Antibes, Cap-Ferrat, Saint-Tropez–account for about 72% of festival-related transactions, with Cap-Ferrat and Saint-Tropez driving higher price per square meter.

- Wealthy international clients from the UK, Belgium, and Switzerland drive around 40% of premium purchases during festival periods, reinforcing the importance of language-ready agents and tailored tours.

- Technique in marketing shifts toward virtual tours and glossy listings; 40% of client interactions now include virtual tours, and 60% request high-quality imagery and 3D floor plans.

- Investors seek an array of property types across coastal locations; about 55% of deals occur in coastal locations, with inland areas within 20–40 km offering value for year-round living.

- December calendar adds roughly 12 major market events along the coast, lifting demand for short-term rentals and long-term holds during the winter period.

- Market intelligence supports steady dynamics: quarterly statistics show resilient price growth and stable yields in the 4.5–5.5% range for short-term rental properties, with clear indicators for strategic locations on the coast.

Key Locations and Tactics for 2025

Focus on terrace-rich properties in coastal locations, highlight tree-lined settings, and pair culinary experiences with property tours to engage clients and accelerate closes on prime beaches and terraces along the coast.

Festival-Driven Buying Windows: Pinpoint Peak Months and Weeks on the Riviera

Target two festival-driven buying windows: late May through early July and late September through October. Lock listings 8–12 weeks ahead of peak weekends, and prioritize apartments with strong views and easy promenade or boulevard access. In saint-laurent-du-var, price dynamics show stabilization after festival highs, providing opportunities for patient buyers. This disciplined investing can help your wealth, with rent demand spiking during events along the promenade and natural coastline. Weve mapped how a well-chosen property can captivate tenants and shorten the time to occupancy, even in a tight quarter.

Peak Months and Weeks

The Riviera experiences the strongest activity in May and June, with peak weeks centered around the Cannes festival window in mid-May and the weekends that follow into early July. A second surge arrives from late September through October, when visitors return to the coast and demand for well-located apartments along the boulevard remains solid. In saint-laurent-du-var and nearby towns, these windows consistently deliver higher occupancy and attractive yields, supported by varied festival schedules, travel trends, and ongoing view-oriented demand from seasonal renters.

Practical Actions for Buyers

Dedicated local agents with terrain knowledge and market access along the promenade can dramatically shorten your search cycle. Set a formal 90-day evaluation cadence for each target property and compare prices across various quarter benchmarks to spot stabilization and favorable terms.

Pre-approve financing, build a shortlist of apartments with strong views and efficient layouts, and prioritize listings that offer easy access to the coastline. Focus on properties with confirmed rental potential during festival weeks, and request recent occupancy and distance data to the promenade and natural beaches to validate your estimates. This approach helps even conservative budgets seize opportunities while avoiding overpayment in crowded markets.

Event Season Rent Upsell: Estimate Premiums on Nights During Cannes, Nice, and Monaco

Recommendation: Implement a targeted event-season pricing plan with a 2–3 night minimum for peak weeks and premium uplifts on prime nights. For Cannes and Monaco, target 25–40% above off-season ADR; for Nice, 15–30%. Align adjustments with the event calendar and refresh rates weekly during the season to reflect riviera demand.

Rationale and data: Occupancy spikes during festival weeks and the Grand Prix, with premium percentages varying by location. Cannes nights typically deliver 30–50% uplifts; Monaco Grand Prix nights often exceed 50–60%; Nice ranges 20–35%. Sources from local agencies and property managers confirm these patterns. Commissions on premium bookings typically range 3–7%, affecting net yield; consider these when building your price offer.

Pricing framework: Use base ADR as anchor, then apply tiered uplifts by date. Core event nights receive 25–40% uplift; high-demand evenings push 45–60%, with a cap to protect occupancy for shorter stays. Keep the structure simple to avoid confusion; offer value by bundling late checkout or airport transfers to boost perceived value. Accessibility across platforms matters, and pricing should reflect Côte d’Azur location dynamics.

Operational considerations: Support during peak hours must be robust; provide 24/7 guest access channels and bilingual service. Implement turnover solutions with precise check-in/out windows to capture back-to-back bookings while maintaining environmental standards. Track commissions and partner performance to keep margins transparent and scalable across the sector.

Market implications: Whether you target domestic buyers or international travellers, opportunities exist on the riviera for homebuyers and investors. Investors and developers running projects can adjust pricing by country and event type; certain countries show higher demand for premium stays. If events draw guests from multiple countries, tailor offers to location-specific preferences while staying compliant with local rules. Use sources and market data to refine your offers and protect yield for the director overseeing the portfolio.

Action plan: Align the calendar through Q2 2025; publish rate cards with dynamic rules; test two price scenarios on Cannes and Monaco nights; monitor occupancy daily; track commissions and profit per stay; review performance after each festival window with a focus on accessibility, client feedback, and ongoing opportunities to optimize the Riviera portfolio.

Demographic Profiles for Festival Shoppers: Who Buys or Rents in Peak Weeks

Target consistently festival shoppers who rent during peak weeks and steer them toward a flexible purchase option near transport hubs. Keep propertys in urban cores and village locations with easy access to venues, and offer week-long packages that align with current price points to improve safe, predictable transactions.

In 2025, the Riviera market shows three clear cohorts. International visitors from the world over rent first, then consider purchase as a long-term option when a suitable opportunity arises. Domestic shoppers from Paris and other French regions mix short stays with longer holiday periods, while local residents and local investors focus on buy-to-let potential, leveraging proximity to events, green spaces with trees, and village atmospheres. Across these groups, the appeal lies in proximity to transport routes, event venues, and a balanced mix of urban convenience and village charm. The dynamic mix is driven by weekly demand cycles, before and during peak weeks, with current price signals guiding both rent and sale decisions.

These profiles inform a practical strategy: tailor listings to emphasize flexible week-based leasing and clear buy options, present neighborhood options by location type, and demonstrate tangible transaction pathways that reduce friction. Include reliable safety features, transparent terms, and a straightforward path from temporary stay to potential purchase, backed by data on average spend and peak-week occupancy.

| Segment | Age Range | Origins / Locations | Peak Week Stay (nights) | Share of Transactions (Rent vs Purchase) | Weekly Rent / Purchase Price (EUR) | Preferred Locations | Transport Proximity | Notes |

|---|---|---|---|---|---|---|---|---|

| International festival shoppers | 28-52 | UK, Germany, Nordics, Benelux, world | 5-7 | Rent 68% / Purchase 32% | 2,400-4,000 EUR (rent) / – | Urban cores; sea-facing village pockets | Within 300-600 m of tram, train, or bus hubs | Strong demand for furnished units; quick decision-cycle; seasonal sale potential exists as buyers test a market before committing |

| Domestic festival shoppers | 29-60 | France (Île-de-France, PACA, Lyon region) | 5-7 | Rent 60% / Purchase 40% | 2,100-3,800 EUR (rent) / – | Coastal towns; village centers; green belts | Near coastal roads and rail lines | Family-oriented stays; longer-term rental options boost appeal; price point remains a factor for purchase consideration |

| Local residents and buy-to-let investors | 35-65 | Riviera locals; regional investors; world buyers exploring local markets | 3-5 | Rent 40% / Purchase 60% | – / 700k-1.6M EUR (purchase price) | Urban neighborhoods; village outskirts with accessible amenities | Strong transport networks; easy access to event zones | High potential for sale or long-term rental; average property values reflect concentration of demand during peak weeks |

Regulatory Checklist for Festival Listings: Permits, Tax Rules, and Short-Term Compliance

Submit permits at least 60 days before listing goes live and lock in tax registrations to avoid last-minute bottlenecks. For Cannes and other coastal towns, license reviews come from both the mairie and the prefecture, so coordinate early with public authorities and your festival partners and tours to keep approvals moving during peak season.

Permits you’ll need encompass event licenses, temporary occupancy, signage, alcohol service, and crowd-management plans. Additionally, schedule a site walk with the infrastructure team to verify access for emergency vehicles and heavy equipment, and align with local police for security requirements–exclusivement in Cannes and other coastal municipalities.

Tax rules and reporting require collecting taxe de séjour from guests or paying on hosts’ behalf and registering with social authorities if you hire staff. If a partner does not meet the standards, penalties may apply. Frequently review local rates and thresholds since European regulations shift by municipality. Keep virtual copies of filings to support audits, and ensure your writing clearly reflects all charges on attendee invoices.

Short-term compliance toolkit includes an always-updated calendar of filing deadlines, a simple template for permits, and a checklist for amenities–better guest experiences while staying within rules. Track precipitation forecasts for outdoor venues, and have contingency plans in place; this helps with crowd flow and safety, reflecting industry best practices.

Position your listing strategy to invest in robust infrastructure across inland and coastal sites. The public sector’s role in supporting festivals strengthens a european, long-term competitive edge; use a technique for communicating permits and timelines to partners and the public, and keep writing concise status updates for sponsors and authorities. This approach mirrors trends in Cannes and beyond, and may boost investor confidence in a regulated, transparent market.

Property Type Leaders During Festivals: Apartments vs Villas and What Sells Fast

Recommendation: Focus on coastal apartments in key riviera towns during festival peaks; they move fastest. Typical days on market: 14–28 for apartments versus 28–45 for villas. Proximity to bars, beaches, and festival venues matters most for speed.

Festival dynamics push demand toward smaller units with efficient layouts and glossy finishes. Properties near main hubs in Nice, Cannes, Antibes, and Monaco attract foreign buyers and local employment sectors in hospitality and events. Ensure strong infrastructure–parking, reliable internet, and security–and highlight a pool or other shared amenities that add value during summer traffic.

When selecting assets, prioritize architecture that blends heritage with modern efficiency. This is particularly appealing to investor demand in Riviera hotspots, where foreign buyers look for easy access to beaches and nightlife. Highlight transport links and proximity to venues to boost attractiveness.

Villas still appeal for longer leases and higher-end buyers, but during festival weeks they sell at a slower pace than apartments. In addition to seasonal demand, villas near beaches and sought-after neighborhoods in the riviera offer added value via privacy and pools, but expect longer closing timelines and careful appraisal of maintenance and staffing needs.

Practical takeaways for investing during festivals

Looking at the data, apartments outperform villas in speed during festival periods. Consider listing strategically: use short-term rental terms, staged interiors, and clear messaging about employment hubs and nightlife. Additionally, emphasize infrastructure, pool access, and easy access to bars and events. For investors focusing on foreign buyers, tailor marketing to their sectors and heritage appeal, and look to investing in properties that can scale quickly in holidays and festival season. Then use these signals to tweak pricing and availability, and monitor added demand during peak weeks.

Festival Marketing Playbook: Targeted Campaigns, Channels, and Offers That Convert

Launch a 6-week festival campaign targeting residents and developers along the southeastern coast, pairing exclusive villa previews with a limited-time price and a maintenance bundle to boost turnover and yield. The plan leverages mild south coast temperatures and aligns with the European festival calendar to attract international interested buyers.

Audience alignments

- Residents: leverage local groups and boulevard events; update propertys listings and place-based content to boost engagement with a property-focused upgrade package.

- Developers and business partners: offer exclusive previews near ferries and road access; present a bundle that includes site due diligence and property management insights.

- Interested buyers across europe and global markets: run multilingual campaigns featuring villa assets and yield potential; highlight wealth opportunities tied to the Riviera lifestyle.

- Local owners who seek a second home: present a turnkey solution, from legal support to interior staging, designed to shorten the path from interest to offer when seasonal demand peaks.

Channels and offers that convert

- Social ads and retargeting: build an array of signals (interested, viewed villa, saved listing), tailor creative by region and property type, and track CTR and lead quality; offer an exclusive villa preview slot for those who convert within a 72-hour window.

- Partnerships and on-site events: partner with hotels, bars on the boulevard, and ferries routes to host micro-tastings and showcase days; offer a festival-pass that includes a private tour and a second-home consultation.

- Email and CRM campaigns: segment by interest stage and send a sequence that combines early-bird pricing, financing options, and maintenance bundles; weave in social proof from satisfied residents and recent sales on the south coast.

- Property portals and media: publish feature stories and virtual tours that emphasize mild climate, coastal access, and the yield potential for European buyers; include a limited-time incentive for registered leads.

- On-site incentives and financing: provide a festival-day package with reduced closing costs, a preferred-rate management plan, and a guaranteed rental yield for the first year on selected villas.

Weve observed that messaging focused on lifestyle benefits along the boulevard, combined with clear financial incentives, consistently outperforms generic promos. When a channel shows strong engagement, scale the offer across the array of audiences, especially for villa projects and southeastern markets where temperatures and demand align. Use a weekly review to adjust creative, refine targeting, and reallocate budget to the most effective channels; this approach helps maintain a healthy turnover and yields across different propertys and business partnerships along the south coast.

Operational Risk and Infrastructure for Festival Properties: Insurance, Maintenance, and Local Logistics

Implement a bundled insurance package for festival properties that covers property damage, public liability, business interruption, and event cancellation. Obtain quotes from sources across local brokers, carriers, and specialty insurers, and benchmark premiums against similar projects in the Riviera region to reflect world standards. For financing, consider sale-and-leaseback arrangements to free capital for risk controls. Expect annual premiums in the Riviera region of roughly 0.8% to 2.5% of asset value, with higher costs for temporary structures, generators, or sites near a dune. Design the coverage with a long-term view and ensure it supports the whole lifecycle of your festival property. Among Riviera stakeholders, align expectations with the market to keep the sale pipeline healthy.

Create a preventive maintenance calendar aligned with festival timelines. Lead maintenance with a dedicated on-site team and a regional network of electricians, plumbers, and HVAC technicians. Keep a spare-parts stock tailored to the asset mix: generators, power distribution boards, water pumps. Maintain a digital logbook and weekly inspections to flag issues early, and set clear house rules for onsite safety and access. This approach keeps back-end work predictable and helps limit risk climbing during peak events. Always drive maintenance decisions with a management view.

Plan local logistics: map inbound routes from ports or airports, confirm permits with local authorities, and set up a regional hub near Nice or Cannes to shorten cargo lead times. Build a network of suppliers and couriers in the region and establish clear lead times for deliveries, staging areas, and crowd-control equipment. Pre-stage essential items, such as fencing and lighting, to support a quick turnaround and attract high-quality clients. The stunning coastal venues along the Riviera require robust logistics and tight coordination with the regional network, among others.

Contracts and risk transfer: embed insurance and maintenance clauses in vendor agreements; require certificates of insurance, performance bonds, and service-level agreements. For foreign-owned assets, coordinate with immobilier teams to navigate licensing, zoning, and permitting. Define the role of the festival management in incident response, and build a roster of local partners who can supply accreditation, waste management, and on-site security.

Observed data from past seasons shows that power outages and weather disruptions drive most downtime. Pre-position generators, automatic transfer switches, and redundant feeders to shorten outages and keep venues operational. Maintain a region-specific risk profile, share it with immobilier and local authorities, and use these insights to attract clients who seek reliability. This commitment supports excellence, builds hope, and fuels a long-term view. Driven by clients who are seeking stability, the program can support innovative improvements later, and might enhance sale prospects in the region.

11 Essential Stats for the French Riviera Property Market in 2025">

11 Essential Stats for the French Riviera Property Market in 2025">

Demystifying Aerodynamics – Can Planes Fly Upside Down?">

Demystifying Aerodynamics – Can Planes Fly Upside Down?">

How to Use Points to Upgrade Cash Flights – The Complete Guide">

How to Use Points to Upgrade Cash Flights – The Complete Guide">

Do I Avoid APR If I Pay on Time? A Clear Guide to Credit Card Interest and On-Time Payments">

Do I Avoid APR If I Pay on Time? A Clear Guide to Credit Card Interest and On-Time Payments">

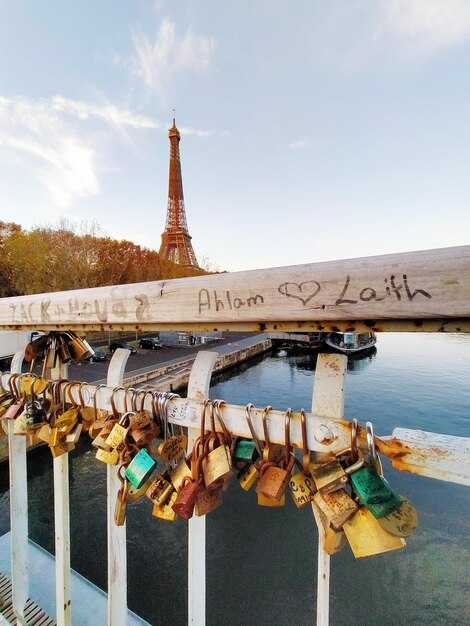

48 Hours of Luxury in Paris – The Pursuitist Passport Weekend Guide">

48 Hours of Luxury in Paris – The Pursuitist Passport Weekend Guide">

Hummsafar Participant Publication – Latest News and Updates">

Hummsafar Participant Publication – Latest News and Updates">

When Does Hotel Elite Status Expire? Your Complete Guide to Expiration Dates, Renewal, and Maintaining Perks">

When Does Hotel Elite Status Expire? Your Complete Guide to Expiration Dates, Renewal, and Maintaining Perks">

Do Cruise Ships Have Gyms? Here’s How to Stay Fit on a Cruise">

Do Cruise Ships Have Gyms? Here’s How to Stay Fit on a Cruise">

Trip Protection 101 – How Travel Insurance Works">

Trip Protection 101 – How Travel Insurance Works">

Hamad International Airport Celebrates Anniversary of ORCHARD Opening">

Hamad International Airport Celebrates Anniversary of ORCHARD Opening">

Vancouver Island Travel Guide – Top Things to See and Do">

Vancouver Island Travel Guide – Top Things to See and Do">