Recommendation: Add an added signer to a card plan to elevate scores over time by strengthening payment history and balancing utilization, and this can give you a clearer path to better notes. This approach also gives added visibility into activity without changing the primary limit.

An added account holder is a designated signer who can spend from the same line while the primary owner retains control over limits, due dates, and access. This setup can improve the availability of data for scoring models, since activity reflects broader habits and regular bill payments. Based on consistent use, that data improves scores over time.

When someone becomes a signer, the reporting routes into the main scoring model, reflecting shared activity. This can ease monitoring and reduce spikes in utilization if payments arrive on time. The mean effect depends on the balance, the amount used, and the cadence of payments, with measurable gains often appearing after a few billing cycles in many cases.

Steps to add a signer: Contact the issuer, provide full name, date of birth, and address, confirm the relationship, and approve a spending limit if available. After setup, review the bill schedule, enable alerts, and maintain daily checks to avoid mispricing. This process can be completed in minutes and gives you control while expanding access for a trusted teammate.

Example: lauren from ohio adopted this approach as part of a strategist plan to elevate scores and support arts purchases. By keeping payments timely and staying within the available limit, she shortened the time to see improvements. She learned that the amount of activity matters, so she focused on the basics: pay on time, keep utilization under a chosen percentage, and receive alerts for upcoming bills. This method was based on steady habits that reinforced responsible spending.

disclaimer: This arrangement is not a guarantee of a specific score movement. Monitor activity and communicate with the issuer to avoid surprises; if misused, it can harm the main account standing.

Practical guide to authorized users and their effects on credit and finances

Start by waiting several months of on-time payments on the main account before adding a designated user; this approach makes management easier and reduces misuse risk.

Adding a designated user ties their file to the primary account, and lenders will see the payment history and utilization on that account; a clean history can increase the designated member’s score, while missed payments lower it. In practice, this applies to linked cards as well, so monitor both the file and the post activity.

Some issuers charge a one-time or monthly fee for the add‑on; verify the license and issuer policy to avoid unexpected costs, and confirm whether the designated user will post to the same accounts or separate records.

Managing tips: set reminders for payments, keep the total balance under a reasonable threshold, and maintain a personal deposit fund to cover slips; this reduces chances that the main account holder must overpay and helps keep the status stable.

Consumers should be aware that even if the designated user is a family member or friend, the impact on their file depends on the main account behavior; lenders look at the total post and payment cadence; if the main payer maintains a solid pattern, the designated member gains status advantages, but if the main payer fails, both sides face consequences; having a clear agreement is essential.

Removal or adjustment after a test period: plan to review after several months; if the idea proves beneficial, you can lead to extending; else remove the designation and reassign access based on performance and need.

Example: sher i is added as a member on gordon’s accounts; the status improves with timely payments and low balances; over several months, the total impact becomes noticeable, and the file shows better reporting across bureaus; this demonstrates how managing one account can help a consumer build a personal history.

Definition and eligibility: who qualifies as an authorized user

Review issuer policies now to confirm who can join; the principal holder initiates the invitation, and the candidate must meet age, residency, and consent requirements. This upfront check reduces harm and clarifies where eligibility varies; here youll invest time to learn which relatives or others are acceptable under the program and what access will be granted.

Who qualifies: usually a spouse or couple, a family member, or a trusted friend, depending on the issuer. Eligibility often hinges on the relationship and consent; certain programs restrict those under a minimum age; others allow the primary to approve access.

Impact on scores and statement visibility: in many setups, activity is reported under the principal’s file and appears on the monthly statement; this impact often increases the primary’s scores or, if misused, harm them. Poor spending by others can push the balance higher, sometimes triggering higher fees and complicating paying obligations. When spending is disciplined, it can also improve the overall standing for consumers involved.

Getting started: if you decide to proceed, collect required details, set spending limits if allowed, and monitor the account. The primary remains responsible for paying; the additional person can access the statement and transaction history, which you receive alerts about and which will be accessed by them. For consumers, staying within limits is crucial. Stay within policies to avoid fees; the balance should be reviewed regularly, alerts enabled, and, if needed, access can be removed.

Credit reporting effects: what gets reported and when

Start by pulling the file every calendar month and confirm each entry; adding documentation and disputing inaccuracies within 30 days of noticing them.

Entries include a loan, amounts owed, monthly payment history, principal, and bill status; the record involves added details that lead the file to reflect activity and status.

Timing matters: new entries may appear within one to two monthly cycles; late bills appear after the due date and lead to a negative mark that can affect future approvals.

Impact and strategy: a high balance relative to the limit or being late often means a weaker profile; keeping every month on-time payments improves the record and provides better financial protection about your overall standing, aligning with traditional guidance. amanda

According to nerdwallet editorial notes, set up alerts for due dates and review monthly statements to catch errors.

| Item | Timing | Details |

|---|---|---|

| On-time payments | monthly cycle | record shows paid on time; lowers risk; leads to a higher profile |

| Missed payments | 30 days late and beyond | record flags delinquency; increases cost of borrowing over time |

| Balance owed | monthly | shows amount owed; main factor in principal balance; informs monthly planning |

| New accounts added | 1–2 months after opening | added to record; connects to principal and monthly bills |

| Collections / charge-offs | after extended delinquency | record signals serious risk; can block access to new loans |

Liability and payment responsibility: who pays for charges

Always verify liability terms with the issuing banks before adding a secondary party to the plan. The primary party remains legally responsible for all charges across the cards, regardless of who incurred them. Unlike deposits, those amounts cannot be shifted to the secondary party.

Maintain a date-stamped ledger of every post and charge, including date, time, amount, and merchant. This clarity helps prevent misunderstandings and supports timely repayments.

EMVCo standards aim to curb fraud; understand that these controls do not erase liability, they simply guide processing. Generally, the liability framework cannot be avoided by the secondary party.

Some banks offer controls or deposit requirements to limit future charges by the secondary party; such features help manage risk, reduce possible losses. thats a reminder that formal terms matter.

To prevent surprises, set a date for payments, document any agreed share of costs, and maintain a working dialogue with the issuing banks. This approach improves a credit-builder profile and reduces major errors that could affect your finances.

Read the official links to the terms, note trademarks, and understand the arts of money management. These steps help you stay aligned with policies and avoid surprises.

Adding or removing an authorized user: typical steps with issuers

Start by confirming the issuer policy: most lenders let you add a secondary name to an existing line of borrowing; if a joint arrangement is available, that option creates shared liability; otherwise you stay non-liable for the other person’s activities. Begin online or call support to confirm options and expected timelines within your account portal.

Gather the required details: name, date of birth, current address, and the last four digits of the identifying number on file; some lenders request a photo ID or digital verification. Have these ready so the process moves quickly; there is little delay if everything is in order, and you can expect a decision within a few business days, especially outside busy sept periods.

Online steps are straightforward: log in, navigate to Account Services or Manage users, choose Add a name, and enter the relationship (spouse, family member, friend) and, if supported, a spending cap. This approach mirrors budgeting goals, helping you keep within a planned monthly spending envelope and reducing the chance of mismanaged activity by other members.

Phone or in-person options exist when online access is limited: call the issuer, provide the same information, and answer security questions to verify identity. Most confirmations get completed within 10–15 minutes, and you’ll receive a reference number to show there the request is underway.

Activation details are important: the new member receives a separate payment instrument linked to the same line; this joining adds flexibility for a couple or family but keeps the primary responsible for paying every due date. After activation, enable budgeting alerts and, if supported, spending limits to elevate staying on track with the year’s plan.

Removing a member follows a similar path in reverse: sign in, go to Manage users, and remove the name. If the person still has the access device, cut it up and destroy it; review any autopay connections and update them as needed. With a joint setup, removal can be more complex and may require closing the existing arrangement and opening a new one to avoid gaps in liability.

Watch for impact on the borrowing profile: mismanagement by a member can reflect negatively on the main account within a short window, so monitor statements monthly and act quickly if there’s unusual activity. These steps are common across most lenders, and handling them promptly helps protecting the plan you’ve built over years of working toward a steady budget and steady paying habits. Even small actions, when done correctly, can bring meaningful benefit and peace of mind.

Best practices and risk management for both sides

Set a formal, written agreement that defines per-month spending caps, allowed uses, and notification rules before adding a secondary holder, so both sides navigate finances with budgeting discipline.

Amanda demonstrates a practical approach: a clear framework is helping families avoid missed payments, limit harm, and create predictable impacts on finances by requiring post-transaction reconciliation on the site every month. Given changes in needs, this structure can be adjusted as the situation evolves.

- Establish role clarity and limits: primary account administrators should authorize every action, secondary holders must stay within defined categories, and the agreement should specify consequences for violations with a simple escalation path.

- Apply alternatives to adapt to growth: use tiered access, temporary spending caps, and optional allowances; enable several automated alerts on the site to catch overspending before it becomes harm.

- Maintain uses and budgeting discipline responsibly: require prompt repayments, monthly reconciliation, and a minimum review of the finances; if a threshold is crossed, revoke or tighten access until things are back on track.

- Strengthen security and privacy: implement two-factor access, rotate credentials, and monitor for suspicious activity; a breach could harm both sides’ finances and trust, allowing fraud to spread.

- Institute a clear payment cadence: prefer paying balances in full when possible and avoid high utilization; align with the primary holder’s due date to minimize late postings and impacts on finances; if you arent aligned, revisit the agreement.

- Set a cadence for reviews and updates: schedule quarterly checks and adjust the agreement in writing; post any changes to the site and circulate a brief update to both parties.

- Capture takeaways and iterate: maintain a shared log of learning, update procedures, and consider innovation that could simplify oversight; this could help either side respond to missed events and improve continuity, with several practical improvements becoming part of the site’s post‑mortem process.

What Is an Authorized User on a Credit Card? How It Works">

What Is an Authorized User on a Credit Card? How It Works">

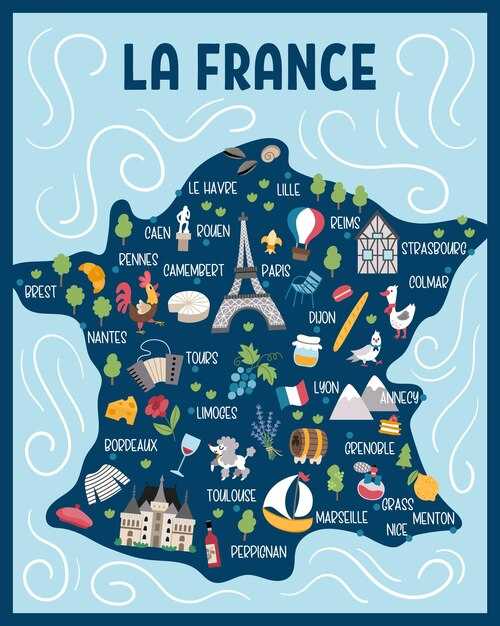

Regioni della Francia – Mappa delle Principali Attrazioni Turistiche per Regione">

Regioni della Francia – Mappa delle Principali Attrazioni Turistiche per Regione">

Previsioni per il turismo in Francia 2025 – Tendenze e Proiezioni">

Previsioni per il turismo in Francia 2025 – Tendenze e Proiezioni">

Ricerca di mercato e consulenza strategica sul turismo in Francia – Approfondimenti di mercato e strategia di crescita">

Ricerca di mercato e consulenza strategica sul turismo in Francia – Approfondimenti di mercato e strategia di crescita">

Analisi del mercato dell'ospitalità in Francia 2025-2029 – Dimensioni e previsioni">

Analisi del mercato dell'ospitalità in Francia 2025-2029 – Dimensioni e previsioni">

Traffico passeggeri negli aeroporti francesi – Tendenze e hub chiave">

Traffico passeggeri negli aeroporti francesi – Tendenze e hub chiave">

Lufthansa First Class Terminal at Frankfurt – An Exclusive Private Terminal Experience">

Lufthansa First Class Terminal at Frankfurt – An Exclusive Private Terminal Experience">

Why Booking in Advance Is Always the Best Choice">

Why Booking in Advance Is Always the Best Choice">

Where to Stay in Oaxaca – The Best Neighborhoods for Your Visit">

Where to Stay in Oaxaca – The Best Neighborhoods for Your Visit">

Where to Stay – A Local’s Top Hotel Picks for an Authentic Experience">

Where to Stay – A Local’s Top Hotel Picks for an Authentic Experience">

Where to Stay in San Francisco When You Visit">

Where to Stay in San Francisco When You Visit">