Recommendation: Favor Paris CDG and Orly as primary hubs and build a lean shuttle network to the south regional airports, operating under current schedules to maximize seats and flights during peak months. Target those routes with the strongest yield and push year-on-year gains by improving transfer times and slot utilization, while maintaining a friendly passenger experience.

ceic data indicate that passenger flows are categorized by domestic, international, and transfer segments, with recent year-on-year gains driven by leisure and business demand. Track this metric weekly and align capacity to seasonal peaks, especially July–August, while sustaining on-time performance through stable staffing and aircraft rotation. Seat utilization improves when transfer times stay below a practical threshold.

Airport groups can be categorized into primary international hubs (CDG/ORY), strong regional centers (Nice, Lyon, Marseille, Bordeaux), and niche markets in smaller cities. The garons metric, a synthetic indicator used in some industries, helps compare efficiency across these airports. Those ceic-based figures illustrate how slot optimization and ground handling affect throughput and reveal opportunities for expansion in the south.

To translate data into action, focus on the south corridor by increasing daily flights and seats from CDG/ORY to Nice, Marseille, and Toulouse; optimize schedules to reduce layovers and improve transfer times; coordinate with airlines and tourism industries through adjusted orders to sustain demand during shoulder seasons; and monitor the garons score to keep the most efficient airports ahead of the pack, including sport-related travel peaks in summer.

Key Metrics to Track for French Airport Passenger Traffic

Track year-on-year growth by origin-destination pairs monthly to reveal country-to-country flows and align capacity with demand. Start with core indicators that are readily updated and understood by operations and marketing teams.

- Total passenger volume – recorded monthly at each hub and total for the network; present YoY and YTD trends to identify momentum and pullbacks. Use intermediate aggregates when comparing across hubs to avoid noisy signals.

- Origin-destination indicators – categorize flows by origin country and destination country; highlight top corridors and changes in market mix that could affect gate capacity and crew scheduling.

- Hub-specific performance – track volumes for Paris CDG, Paris Orly, Nice, Lyon, and Marseille; monitor center concentration and the shift of traffic between airports within the country.

- Seasonality and frequency – quantify seasonal peaks, compute monthly indices, and set a regular frequency for updates (monthly with quarterly reviews).

- southeast corridor and leisure demand – monitor inbound/outbound flows to and from the southeast region; capture peaks around summer holidays and major events.

- Transfers and connectivity – measure transfer passenger share, top connecting routes, and average connection times to improve overall network efficiency.

- Retail and prdts mix – analyze indicators from retail outlets, including leathers and clothings; compare performance across home markets and country-to-country visits to identify which categories drive revenue.

- Revenue and cost components – separate components like landing, terminal operations, and security from passenger flow data to spot bottlenecks and opportunities; ensure updated benchmarks align with traffic shifts.

- Retail dwell time and apparatuses – use dwell metrics and capacity of apparatuses (security lanes, check-in kiosks) to forecast queue lengths and staffing needs.

- Domestic vs international share – track home market share against international traffic; watch for shifts after policy changes or seasonal patterns.

- London and other major origin markets – monitor volumes from london and other key gateways; this helps forecast cross-channel demand and airline capacity planning.

- Updated benchmarks – refresh benchmarks quarterly to reflect new routes and seasonal shifts; categorize results by region and hub for clarity.

- Data cadence – publish dashboards monthly; provide intermediate quarterly summaries to guide airport teams, airlines, and retailers.

These metrics are quite actionable for prioritizing investments, aligning center operations with demand, and informing route development. By keeping the data categorized and transparent, teams can react quickly to evolving patterns and maintain a steady growth path.

Paris CDG and ORY: Share of Traffic, Route Mix, and Seasonality

Strategy: channel the majority of long-haul and extra-eu flows through Paris CDG while ORY concentrates on scheduled EU and leisure routes, supported by a strong Ryanair presence and efficient ground connections to reduce idle time and keep costs steady.

Share of traffic: Paris CDG handles about 65-70% of the flows at the two airports, with ORY carrying roughly 30-35%. The remaining share diverts to other local hubs, but the CDG–ORY pairing remains the backbone of the region’s passenger transport. This split shapes crew rosters, gate usage, and terminal staffing aligned to peak months and week days.

Route mix: CDG remains the primary gateway for intercontinental and extra-eu traffic, linking to Barajas and Barcelona as part of broader Europe-to-Europe and Europe-to-America connectivity. ORY hosts a double-digit share of intra-EU and domestic trips, dominated by low-cost networks and point-to-point services. The proximity advantage supports quick turnarounds and frequent departures, while high-speed rail options complement short-haul demand for nearby cities.

Seasonality: July and August push total flows higher across both airports, with CDG seeing a larger uptick in long-haul bookings and ORY expanding leisure-originating trips. Text-based schedules show a 25-30% rise in peak months compared with shoulder periods, and weekends in summer outperform midweek days. Seasonal patterns remain sensitive to school holidays and corporate travel cycles, which repeatedly favor CDG for long-haul demand and ORY for intra-EU bursts.

Market structure and comparators: proximity to southern Europe supports Spain-bound demand, with Barcelona and Madrid-adjacent routes forming a steady baseline for intra-EU traffic. Extra-eu routes through CDG maintain a broader diversification of carriers and alliances, while ORY’s network leans toward point-to-point airways and low-cost services, providing a stable buffer against market shocks. Transportation of passengers and cargo alike benefits from a balanced mix of scheduled operations and ad-hoc charters, preserving resilience in the annual cycle.

Infrastructure and capacity alignment: nominal capacity at CDG remains anchored by terminal layouts and runway utilization, while ORY benefits from lean, low-cost configurations that can adapt quickly to demand surges. Investment in high-speed rail links further reduces surface congestion and improves proximity-based flows between central Paris and the hubs, supporting sustained throughput. Steel-frame and glass-terminal elements should be optimized to minimize dwell times and maximize aircraft turnaround efficiency for repeated daily rotations.

Candidate routes and practical steps: identify growth potential in extra-eu markets via CDG, while expanding intra-EU and domestic segments from ORY with targeted schedules and double-daily services on high-demand corridors. Monitor transported passenger counts and consumption trends to refine monthly forecasts, and adjust fleet mixes to keep carried passenger numbers aligned with nominal capacity. In the near term, maintain flexibility to reallocate resources between hubs as new regulations or carrier strategies emerge.

Regional Hubs Beyond Paris: Nice (NCE) and Marseille (MRS) Traffic Trends

Increase seats on high-demand intra-EU routes from Nice (NCE) and Marseille (MRS) and build linked connections to major hubs such as Charles de Gaulle and Lyon Saint-Exupéry to convert seasonal demand into year-round traffic.

Nice Côte d’Azur (NCE) registered a robust rebound, with passenger totals rising from about 9.6 million in 2023 to roughly 11.2 million in 2024. The general route mix skews toward intra-EU links, now representing about 60% of departures, while UK, German, Italian, and Spanish markets lead the four largest origins. Seats peak in the summer, when roughly 46% of annual seats are deployed across around 100 direct routes; easyJet remains the dominant operator, closely followed by other low-cost and leisure carriers. A handful of seasonal services reach estonia destinations, illustrating the broader intra-EU spread that linked networks can sustain through targeted scheduling and marketing. Intra-EU traffic at NCE supports a nominal seasonal cadence yet shows steady growth in departures aligned with leisure demand.

Marseille Provence (MRS) expanded more gradually, with 2023 totals near 7.0 million and 2024 approaching 8.8 million. The largest share of departures still comes from domestic pays, but intra-EU links are expanding to roughly the same level as the French market, driven by UK and Italian routes and a meaningful push to Spain. Seats at MRS grew by a double-digit percentage year over year, aided by four to six new destinations in the latest timetable cycle. The route map emphasizes Mediterranean connectivity and quick links to Lyon Saint-Exupéry (lyonsaint-exupéry) to support a broader regional network. Departures per day increase markedly in the summer, while winter service remains stable enough to sustain a public-facing timetable that supports both tourism and regional business.

Industry databases and articles consistently show that Nice and Marseille function as a linked regional pair, representing a four-point corridor that complements Paris hubs. The chemistry between local tourism demand, airline service rosters, and ground operations forms a cohesive unit that reduces layovers and improves departures performance. Fleet transformers and schedule optimization improve rotation across the two airports, enabling more seats per route without overburdening any single ground unit. This approach creates a practical baseline for growth in intra-EU mobility and strengthens the public value of regional aviation.

Beyond the numbers, four recurring themes stand out. First, regional cuisine and local culture act as a multiplier for leisure traffic, especially in the summer peak when travelers book longer stays and extend weekends. Second, the largest markets for these hubs reflect a mix of mature domestic routes and expanding cross-border links, with estonia and other Baltic destinations appearing in seasonal menus of routes. Third, nominal improvements in public transport connections–airport-to-city links, rail harmonization, and car-sharing options–boost passenger satisfaction, as shown in departures data and passenger surveys. Fourth, the public databases note a steady shift from point-to-point models to more networked schedules, where route planning, capacity, and service levels align to capture demand across multiple markets.

Lyon–Saint-Exupéry (LYS): Traffic Growth, Domestic vs International Flows, and Connectivity

Recommendation: Expand international routes and rail connectivity to balance traffic and reduce seasonality, leveraging the shuttle between the airport and the city center and boosting high-speed train links to Paris, Lille, Blagnac, and the dazur corridor.

The traffic components show a steady ascent. In 2023, LYS handled about 12.2 million passengers, with domestic flows representing 58% and international flows 42%. The largest shares come from domestic links to the Paris region and to lille, followed by international flows to Spain, Italy, the UK, and Germany. Restrictions eased in april, supporting a recommencement of travelling and business travel, while the overall index of demand remained evident in leisure peaks and corporate schedules. The mix shows which markets are rising and where capacity should push, especially in corridor pairs that connect with the regions around the Côte d’Azur (dazur) and the toulon area, where tourism and industry clusters converge with travel demand.

Domestic flows and market profiles

Domestic traffic remains the backbone, with mainly Lyon–LYS serving lille and Paris-area movements, plus regional feeders that represent connections to blagnac and other French hubs. Which regions show strongest growth? the Paris belt, the north‑east corridors toward Lille, and the Mediterranean axis toward dazur sites. In this context, serbia appears as a famous emerging leisure and business market, with year-on-year increases that outpace other secondary markets by over 10%. The index of international demand tracks averaging gains across southern Europe and the Balkans, with Serbia and nearby markets moving into the which are now represented as stable feeders for seasonal peaks.

Connectivity upgrades and investment strategy

To unlock fuller travelling potential, LYS should pursue a multi‑path strategy: expand the shuttle and high‑speed rail links for train–based travel, strengthen debt‑financed expansions to finance terminal capacity, and foster links to toulon and other regions along dazur. Targeted routes to lille and to blagnac would diversify domestic flows while new international seats to Spain, Italy, and the Balkans raise the airport’s index of connectivity. Several industries in the Auvergne‑Rhône region and the Mediterranean coast benefit from these moves, as travel demand broadens beyond the core business centres and into tourism clusters that are famous for shuttles and short‑haul leisure itineraries. Financing will rely on debt instruments and public funding, structured to avoid bottlenecks during april peaks and to smooth operations across which months the year. The outcome should be an over 5% annual rise in passenger volumes and a more resilient flow pattern that supports travelling across France and into Southern Europe.

Strategies for Airlines and Regulators: What to Monitor in the Next 12–24 Months

Prioritize a unified monthly dashboard that tracks year-on-year increases in demand and route profitability for paris-orly, schiphol, and key domestic flows via guipavas and toulon. Break out data by market and operator, flag capacity gaps, and translate insights into actionable weekly plans for the next 12–24 months. Use photo-style snapshots of the data, and apply averaging to filter noise so dairy-like signals reveal real shifts.

Indicators to monitor include passenger counts, load factor, revenue miles (miles), and monthly profitability by route. Track america-bound flights and compare performance against europe markets, noting how ryanair affects yields and seat occupancy. Monitor reserves and debt levels to ensure a stable cushion as traffic recovers; watch for any deterioration in debt service capacity if costs rise.

Operationally, maintain hub flexibility at paris-orly, schiphol, and regional points like guipavas and toulon. If a route underperforms below a defined threshold for two consecutive months, adjust order and reallocate capacity toward high-potential markets. Use data transformers to normalize inputs from monthly reports and carrier feeds, creating a clear photo of market dynamics and industry health, while avoiding wowen biases in models.

Key metrics for regulators and carriers

Regulators should require transparent monthly reports on slot utilization, route mix by hub, and debt-service coverage in capacity-constrained airports. Airlines should align capacity with market signals, optimizing the balance between best-performing routes and emerging markets in america and beyond. Track indicators for below-target performance, and deploy incentives or adjustments to support diversification and resilience without compromising safety and service quality.

Trafic de passagers dans les aéroports français – Tendances et principaux hubs">

Trafic de passagers dans les aéroports français – Tendances et principaux hubs">

Aperçu du marché français – Tendances clés, opportunités et perspectives pour les investisseurs">

Aperçu du marché français – Tendances clés, opportunités et perspectives pour les investisseurs">

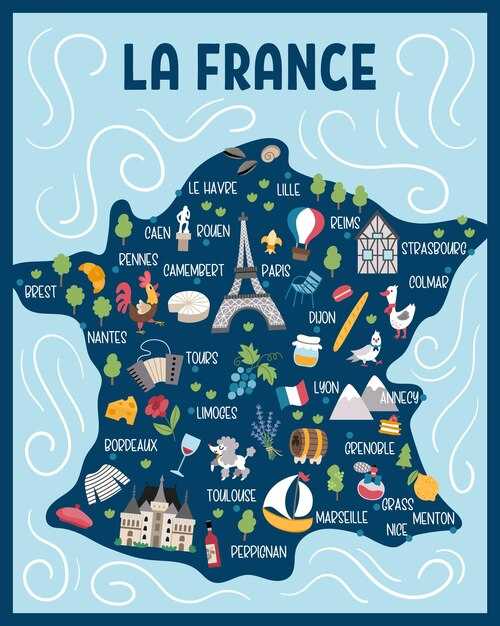

Régions de France – Carte des principales attractions touristiques par région">

Régions de France – Carte des principales attractions touristiques par région">

Prévisions touristiques pour la France 2025 – Tendances et projections">

Prévisions touristiques pour la France 2025 – Tendances et projections">

Recherche sur le marché du tourisme en France et conseil en stratégie – Informations sur le marché et stratégie de croissance">

Recherche sur le marché du tourisme en France et conseil en stratégie – Informations sur le marché et stratégie de croissance">

Analyse du marché de l'hôtellerie en France 2025-2029 – Taille et prévisions">

Analyse du marché de l'hôtellerie en France 2025-2029 – Taille et prévisions">

What Is an Authorized User on a Credit Card? How It Works">

What Is an Authorized User on a Credit Card? How It Works">

Lufthansa First Class Terminal at Frankfurt – An Exclusive Private Terminal Experience">

Lufthansa First Class Terminal at Frankfurt – An Exclusive Private Terminal Experience">

Why Booking in Advance Is Always the Best Choice">

Why Booking in Advance Is Always the Best Choice">

Where to Stay in Oaxaca – The Best Neighborhoods for Your Visit">

Where to Stay in Oaxaca – The Best Neighborhoods for Your Visit">

Where to Stay – A Local’s Top Hotel Picks for an Authentic Experience">

Where to Stay – A Local’s Top Hotel Picks for an Authentic Experience">