Plan shoulder-season travel in May or September to maximize value and minimize queues at iconic sites. Data provided by Atout France and partners show inbound visitors in the tens of millions annually, with the centre of gravity focused on Île-de-France and the coast. The pattern is linked to major events, where strong attendance drives hotel occupancy and passenger flows away from peak months, providing economically important benefits to local communities in the location.

Seasonal shifts are evident when you compare regions: the location cluster around Paris and the seaside arcs of the Côte d’Azur and Brittany capture the most visitors, while inland clusters sustain steady demand year-round. In 2023–24 cycles, occupancy rates in city centres and beach towns rose strongly during spring and late summer, with trips often planned as multi-stop itineraries linked across urban culture, seaside leisure, and mountain escapes. Compared with 2019, regional patterns show growth at coastal and urban locations but slower uptick in some inland spaces.

Risks and impacts to watch include weather variability, strikes, and transport disruptions that affect travel timing; data from the vanat dataset show that hotels and transport providers respond to event calendars, causing spikes in demand. For resilience, spread risk by booking flexible options and considering alternative locations along the coast or inland. The minimum length of stay in most resort towns tends to be a long weekend, while city breaks often require 3–4 nights to unlock the full array of sights.

For planners, a practical approach pairs a metropolitan stay with a seaside segment and, if possible, a mountain stop at elevation above 1,000 meters. This multi-location strategy reduces risk of weather days and makes it easier to balance budgets. In the French seaside corridor, choose linked sequences such as Paris centre + Côte d’Azur or Brittany coast, taking advantage of high-speed rail connections–the minimum travel time between hubs often sits around two hours on fast lines. Among the event-driven peaks, summer festivals and winter ski seasons show strong visitation, and planning around these helps maintain a steady flow of visitors while keeping costs manageable.

Latest visitor arrivals to France and year-over-year growth

Target top markets (UK, Germany, US) and optimize same-day ticketing to lift occupancy during peak periods. Align opening hours of major attractions with flight patterns to capture early visits and extend stays in the same-day window when feasible. Focus on diverse experiences across Paris centre, the Riviera, and other regions to spread demand and reduce congestion.

Definition: Arrivals refer to international visitors entering France for any purpose, including same-day visits. Public agencies, including the national tourism board and INSEE, provide these figures, and the latest releases are cited in industry analyses. The newest data show YoY growth in visitor arrivals ranged roughly from 4% to 9% across leading origin markets, with stronger gains in the UK and US categories among cited sources.

Shares and leading markets have remained stable in structure: the United Kingdom, Germany, the United States, and Spain lead inbound visits. Within the EU, UK and Germany contribute the largest shares, while the US shows notable expansion in popularity and contribution to overall tourism. The dynamic mix reflects a diverse range of preferences and a broad set of attractions that play a key role in sustaining demand across seasons. The same markets continue to show occupancy gains during the peak months, particularly in major city-centre zones and popular resort corridors.

Occupancy at top attractions stayed high during peak season, with venue occupancies often ranging from 75% to 90% on weekdays and higher on weekends. Opening windows extended into late evenings at several museums and monuments, and same-day ticketing options via providers helped manage crowd flows. The shares of attendance by attraction type show that cultural sites, waterfronts, and alpine and coastal resorts drive the lion’s share of visits, particularly for day-trips and short stays. Popularity remains strongest for Paris centre experiences, followed by the Côte d’Azur and major regional centres, while other regions show rising momentum during shoulder periods.

Evidence and context from the umweltstiftung and public-sector analyses emphasize that growth in arrivals brings positive economic contribution if managed sustainably. Included data cover a broad range of providers, from public centres to private operators and tour operators, highlighting how opening strategies and issue-focused stakeholder collaboration shape outcomes. Ranges in arrival volumes indicate continued strength in demand, with growth patterns cited across areas that benefit from diverse attractions, seasonal promotions, and improved public transport access.

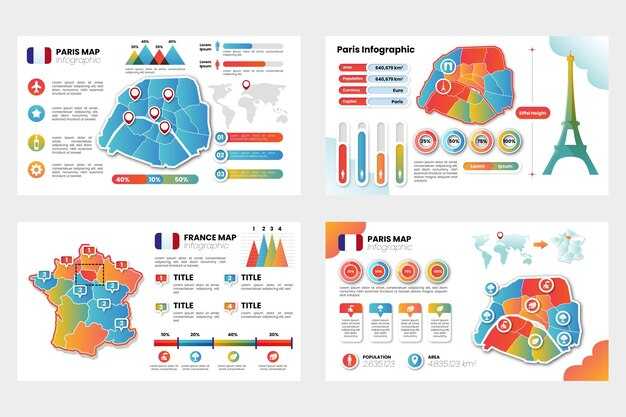

Regional and city distribution of visitors in France

A single, targeted campaign for the Île-de-France region should anchor your strategy, capturing the largest share of inbound visitors and guiding annual budgets toward the most productive channels, boost spending.

Regional distribution shows Île-de-France attracting the majority of visitors, with annual arrival rates typically in the 40-50% range for overnight stays. Provence-Alpes-Côte d’Azur follows with 12-18%, Auvergne-Rhône-Alpes 8-12%, Nouvelle-Aquitaine 6-11%, and Occitanie 6-10%; the remaining regions share the rest. This breakdown presents a clear path for prioritization.

frances analyses show Paris dominates the visitor mix, more than any other city, with Paris itself accounting for a large share of overnight stays. Lyon, Nice, Marseille, Bordeaux, and Toulouse follow as important secondary cities, while Nice sees pronounced summer spikes along the Côte d’Azur.

Seasonality shapes campaigns. Coastal destinations push for July-August, while inland cities perform well in spring and autumn, though some regions see stronger summer growth. Domestic citizens contribute steady weekend traffic to Paris and other cities, and the pattern is pretty consistent across years, supported by event calendars and local festivals.

To boost spending, bundle regional experiences and align with local suppliers, guiding visitors through multi-city itineraries that spread spend beyond Paris. Multi-region offers should tap into opportunities like wine routes, museums, and family-friendly activities, created with transparent pricing and simple booking flows.

Applications for visitor-facing platforms should highlight regional routes and responsible tourism practices. vanat analytics confirm these patterns, and the aim is to present clear itineraries that connect main hubs with lesser-known towns, creating opportunities for local communities while maintaining quality and sustainability.

Top source markets for French tourism and their growth trends

Target the UK and German markets first with tailored, travel-related packages to lift visits quickly and reliably. Build a focused split of campaigns across channels and formats to maximize reach during the june peak window.

Observations confirm the strongest markets: the uk and germany lead, followed by the united states and the netherlands, with many visits coming from these corridors. romanian travelers show a notable uptick. The attractiveness of France varies by region, creating a basis for localized offers that reflect water experiences, gastronomy, and sports calendars; this adds depth to each market’s options.

Growth trends for the first half of 2024 show the following: uk visits up roughly 4–5%, german visits around 3–4%, us growth near 6–8%, and netherlands around 5–6%. In june, demand for coastal stays and city breaks crossed the threshold, pushing occupancy and overnight visits to new highs. At this moment, several destinations posted records for early-summer stays, despite seasonal dips elsewhere.

To translate these changes into revenue, apply practical solutions and options: co-brand rail-and-air packages, flexible cancellation policies, and bundles that add water-based experiences along the coast; partnerships with sports venues and events tap into the sports calendar. Focus on romanian and other markets with content adapted to their expectations, while keeping just enough capacity for peak demand. Maintain a reliable data dashboard to track scope, developments, and visits by market, and adjust tactics as needed.

Seasonality and monthly patterns in France tourism

Recommendation: Promote spring and autumn cultural itineraries in less-visited areas to spread daily arrivals and reduce reduction in peak pressure on infrastructure.

Eurostat collected monthly indicators show that peak months remain very dominant for inbound tourism, with July and August sharing a large portion of overnight stays. In winter, snow-reliable regions retain demand, while urban cultural trails keep a steady stream of guests in shoulder periods. Public and private sectors can use these points to balance incomes across settlements and support a collective strategy that reduces reliance on single months.

Seasonal dynamics by period help operators tailor offers and pricing, promoting a more balanced flow of guests across France’s diverse areas.

- Winter (December–February):

- Snow-reliable zones in the Pyrenean and other alpine areas attract guests focused on ski experiences; daily arrivals concentrate around holiday weeks, while off-peak weeks see a reduction in occupancy. This pattern benefits resorts that coordinate lifts, lodging, and transport through public–private integration, ensuring hospitality remains welcoming even in quieter days.

- Smaller cultural towns stay active through regional events and winter markets, offering a cultural counterpoint to ski towns and helping spread shares of staying visitors.

- Spring (March–May):

- Cities and cultural routes become snow-free and highly accessible, drawing guests with cultural and culinary programs. Incomes rise in key corridors as packages combine museums, seasonal markets, and countryside experiences in less congested areas, supporting a more balanced daily footprint.

- Coastal and inland settlements partner with farmers’ markets and festivals, creating a snow-free, welcoming rhythm that attracts both domestic and cross-border guests.

- Summer (June–August):

- Coasts, Provence, and major metropolitan hubs peak, with very high occupancy levels. The share of international visitors remains strong, particularly in Paris and the Riviera, but regional towns can leverage day trips and multi-day stays to extend the season–this is a key point for promoting cultural routes beyond the top beach spots.

- Dynamic pricing and targeted promotions help manage capacity in popular settlements, while local residents support a public–collective approach to hospitality that preserves welcoming atmospheres for guests.

- Autumn (September–November):

- Shoulder months bring fewer crowds but richer cultural events–wine harvests, autumn festivals, and historical tours bolster daily visits and reduce pressure on peak-season services.

- Incomes stabilize as guest stays lengthen in urban and rural areas, with regional trains and bus networks improving access to Pyrenean trails and regional settlements, enabling more sustainable visitor shares through the season.

Practical actions for destinations:

- Align promotions with monthly patterns by targeting cultural, culinary, and nature experiences in less-visited areas to smooth daily arrivals.

- Invest in snow-reliable infrastructure in mountainous settlements and ensure cross-season connectivity to maintain daily flows during shoulder months.

- Enhance data collection and integration across public and private partners to track shares, collected metrics, and reductions in peak-season strain.

- Develop inclusive packages that share accommodations, attractions, and transportation, promoting a collective approach to regional incomes and sustainable tourism growth.

Overnight stays versus day trips: implications for tourism planning

Target a 15-20% lift in overnight stays by converting weekend and shore-day-trippers into multi-night guests with value-packed packages, flexible check-in, and hospitality add-ons.

In the latest report, overnight stays accounted for the majority of tourist nights in year 2023. The share by region shows seaside destinations above the national average and inland towns relatively lower. Across months, June through August deliver the highest volumes, while the lowest occupancy occurs in January–February. The pattern is referred to in regional data and is often compared with andalucía and other southern areas. The analysis also breaks out resident visitors, with international markets such as greek and romanian travellers contributing a meaningful portion of overnight nights when campaigns reach them.

Strategic actions for planners

- Shift a portion of the day-tripper pool into overnight stays by offering two- to three-night packages that include lodging plus curated local experiences; make these available through the opening of seasonal channels and online hospitality platforms.

- Expand capacity in small seaside towns with flexible check-in, late arrivals, and cross-promotion with restaurants and cultural events; ensure marketing covers lodging and experiences to boost perceived value.

- Coordinate with transport and accessibility improvements to make it easy for residents and visitors from other countries to stay longer, including efficient rail connections and affordable airport transfers away from peak hours.

- Test experiments with price ladders by month and nationality segments; monitor nights per visitor, average length of stay, and return visits to gauge impact on overnight shares; report results quarterly to refine strategy.

- Develop regional campaigns focused on family visitors from countries like greek and romanian, with seaside and inland options; emphasize opening events and off-season offers to keep occupancy above the lowest level and maintain steady hospitality revenue.

Tourism by purpose: leisure, business, and events in France

Prioritize leisure travel as the core driver and tailor offers for business and events around it. In France, leisure visits account for roughly 60% of international arrivals and about half of tourism expenditure, while the combined share of business and events makes up the remaining portion. This focus supports the whole economy and helps operators align resource allocation with actual demand.

Paris Île-de-France leads in international overnight stays and conference activity, holding around 40% of arrivals, while the dazur area along the Mediterranean captures a large share of seasonal leisure and major events. Beyond Paris, the remaining regions balance demand across areas such as the Alps, the Atlantic coast, and wine routes, with regional profiles shifting by season.

Same-day travel grows in coastal resorts and city centers; operators should build same-day offers and flexible booking to capture spontaneous trips. Online platforms and on-site service present convenient options, helping retail outlets and hotels convert a point of arrival into a paid stay.

Classification by purpose helps map the product mix across accommodation, transport, and events. Leisure drives higher occupancy and production in hotels, while business trips sustain corporate services and meetings venues; events trigger spikes in transport and retail activity, with remaining demand often combining leisure and business.

International markets show steady interest from Swiss travelers and other European groups; visa rules influence planning for these segments. Tourism bodies should present clear visa guidance and simple application steps to reduce friction for travelers.

Expedia and other OTAs shape a large share of the distribution, especially for leisure packages. Allianz-backed service guarantees, flexible cancellation, and clear insurance offers improve conversion and reassure visitors. Use this channel mix to extend reach beyond traditional touchpoints, while tracking impact on the whole value chain.

Data found in Beniston’s climate analyses indicate peak demand windows in dazur and the Alpine areas shift with the seasons, guiding promotions and staffing. Cross-destination ideas, such as a French event paired with a short extension in kalymnos, illustrate how international packages can attract visitors seeking both business and leisure. The approach supports the present international footprint, helps same-day opportunities, and reinforces the economy across every remaining market segment.

Demographic shifts among visitors: origin, age, and trip duration

Target 25–44-year-olds from italy and poland with 4–6 night packages in ski-regions and natural settings, pairing water-based activities with eco-tourism and retail offers in french centres. This approach leverages the average spend of this group and aligns with french policies that manage capacity and seasonality within the scope, while staying within limits.

Source data show that flows from italy and poland remained high through 2024, with italy and poland among the strongest growth markets. Economically, these visitors are likely to stay longer, namely in several destinations, and to mix centre experiences with mountain and coastal stays. The average stay length rose to about 5.2 nights, while the so-called domestic flows stayed very resilient. The market decided to diversify channels, with similar patterns emerging across regions beyond core gateways.

To widen the scope, managers should pair targeted marketing with flexible package design that bridges ski-regions, coastlines, and eco-tourism sites. Policies should encourage sustainable retail experiences in centre towns and smaller natural destinations, ensuring water-based activities remain safe and accessible. This balanced approach helps maintain high flows while protecting limits on capacity and natural resources.

| Origin | Age | Average nights | Share of visits | Top destinations |

|---|---|---|---|---|

| italy | 25–44 | 5.6 | 4.7% | ski-regions; centre |

| poland | 25–44 | 5.0 | 2.8% | coastlines; centre |

| united kingdom | 45–64 | 6.1 | 7.3% | ski-regions; natural |

| germany | 25–44 | 5.4 | 9.8% | ski-regions; water towns |

| france (domestic) | 18–24 | 3.7 | 9.4% | coastal towns; eco-tourism |

| spain | 18–24 | 4.6 | 3.1% | natural sites; centre |

France Tourism Statistics – Visitor Numbers & Trends">

France Tourism Statistics – Visitor Numbers & Trends">

What to Do in Nice, France: A Complete Guide to the French Riviera Gem">

What to Do in Nice, France: A Complete Guide to the French Riviera Gem">

What Is France Known For? Discover Culture, Cuisine, Landmarks, and More">

What Is France Known For? Discover Culture, Cuisine, Landmarks, and More">

Πολιτιστικός Τουρισμός στο Παρίσι – Τα Βασικά – Μουσεία, Αξιοθέατα & Τοπικές Εμπειρίες">

Πολιτιστικός Τουρισμός στο Παρίσι – Τα Βασικά – Μουσεία, Αξιοθέατα & Τοπικές Εμπειρίες">

Η Τράπεζα της Γαλλίας Μειώνει τις Προοπτικές Ανάπτυξης και Πληθωρισμού για το 2025-2026">

Η Τράπεζα της Γαλλίας Μειώνει τις Προοπτικές Ανάπτυξης και Πληθωρισμού για το 2025-2026">

Γαλλική Εθιμοτυπία 101 – Τι πρέπει και τι δεν πρέπει να κάνουν οι επισκέπτες – Γρήγορος οδηγός">

Γαλλική Εθιμοτυπία 101 – Τι πρέπει και τι δεν πρέπει να κάνουν οι επισκέπτες – Γρήγορος οδηγός">

France Sets a Record for Tourist Arrivals, While Tourism Revenue Lags Behind Global Competitors">

France Sets a Record for Tourist Arrivals, While Tourism Revenue Lags Behind Global Competitors">

France Travel Changes and Industry Trends 2025 – What to Expect">

France Travel Changes and Industry Trends 2025 – What to Expect">

Airports and Direct Flights to France – Your Comprehensive Guide to Major Hubs and Direct Routes">

Airports and Direct Flights to France – Your Comprehensive Guide to Major Hubs and Direct Routes">

Buy Prepaid Tourist SIM Card France – Paris | Travel SIMs">

Buy Prepaid Tourist SIM Card France – Paris | Travel SIMs">