Recommendation: Cruisers who sail frequently and value flexible bonuses may gain real value from tiered rewards, backed by barclays, plus everyday perks that fuel back-to-back voyages.

Opening context: earnings are tiered by spend, with elevated bonuses at higher tiers; everyday purchases build momentum, while cruise-specific periods unlock gifts for cruisers and family travelers. link to terms and official details should be reviewed, especially if you plan to travel with next voyage in mind.

nerdwallet notes that design emphasizes simplicity; service framework from barclays supports rewards flow, honored member status for cruisers. regarding business-use, this product can support small ventures sponsoring travel with rewards, but may not fit everyday spenders who doesnt cruise often.

Next steps: compare expected everyday rewards against annual charges; wash away hype by reading real user experiences; like-minded family cruisers can stack bonuses with gifts and opening offers; considering dining and bar-service spend may push tier upgrades higher, boosting overall return.

Bottom line: for cruisers who value a link to rewards, ongoing service from barclays, and flexible bonuses offered during next voyages, this card warrants serious consideration. opening discussions with trusted sources such as ner dwallet, plus cross-check with issuer terms, will help decide whether fits business travel or family trips.

Carnival World Mastercard 2025: Is It Worth It? Here’s the Breakdown

Recommendation: skip unless you sail multiple times per year and can carry value from coverages, cancellation protections, and discounts.

- Value versus annual expense: if you sail fewer times than a threshold, net gain could be negative over years.

- Coverage details: exact coverages, cancellation protections, trip interruption rules; verify medical coverages to avoid surprises during trips.

- Discounts and onboard credits: main benefit could be saved on stateroom bookings, specialty dining, and shore excursions; check where discounts apply during cruises.

- Limitations: not all itineraries qualify; confirm whether benefits apply where ships operate and during port calls or special events.

- Upgrade paths: member status boosts, generous rewards, best cases occur when annual spend meets thresholds; next year could be brighter for ongoing travel.

Bottom line: loyal cruisers, who travel often and can use coverages, discounts, and stateroom savings, could find this option excellent; writer notes benefits grow with years of activity and with routes such as Sapphire or Princess.

2 Earn Bonus FunPoints Right Out of the Gate

Recommendation: Open a carnival-branded line of cards and trigger an introductory bonus by making a qualifying purchase within 60 days to receive 2,000 FunPoints right away. This move has been favored by many users for straightforward value and quick payoff.

Qualifying purchase must post within 60 days; some items get excluded, so limits apply. If youre pursuing longer-term value, separate everyday buys from big-ticket purchases to maximize initial boost, and youd receive full value before rules shift through official disclosures. Some rules require you to keep certain spending within eligible categories; special prompts may appear during signup, so read all requirements.

Earned FunPoints post at a fixed rate per purchase; once earned, funds sit in your balance until you convert. Through partner redemptions, you could exchange points for travel, merchandise, or dining; editor-curated options highlight high-value picks. Youre able view redemption values to know exactly what youre getting, and youd avoid low-value paths by sticking to kind redemptions with strong return, while their partner networks extend options beyond basic catalogs.

Be mindful about interest: carrying a balance could reduce overall value; pay in full to avoid. Longer cycle means more time before payment; Right approach centers on spending within ability to pay and directing rewards toward laundry tasks, office needs, or other business-related purchases. Youre still gaining value from ongoing spend across categories, with some purchases earned even if separated across months.

Bottom line: this route delivers immediate 2,000 FunPoints boost from initial purchase; ongoing earning remains solid if you maintain disciplined payback. Youre able to track progress in a single view, and youd decide on whether to proceed based on your spending profile and existing limits. If you want to maximize this kind of rewards, obtain one of these cards after weighing personal and business needs right away. Points obtained during signup could be redeemed later.

Instant Sign-Up Bonus: How the 2 FunPoints post after approval

Recommendation: claim 2 FunPoints immediately after approval; expect posting nearly within 1–2 billing cycles to confirm. If youre points missing, run a quick update to personal details and reach editor support; stay proactive, keep a close eye on activity, without delays you gain savings that stay with you for good, available only once per account.

Two FunPoints arrive as credits that gives discounts on merchandise, gifts, and park visits. In market coverage, value in cents roughly aligns with a few dollars toward items such as luggage or laundry supplies; you could double benefits by applying points to bundles of gear plus boarding needs, enough to cover small purchases.

Stay alert for updates; ensure accurate in points posting in your account. If miscategorized, contact editor to correct; youre able to keep credits across multiple purchases; their savings grow when applying points toward luggage or park merchandise. Stay mindful to avoid abusive charges and manage risk without harming personal finances.

| Timing | 2 FunPoints post within 1–2 billing cycles after approval; if delayed, use update channel to notify support and editor |

| Verification | Open app or online account; ensure youre personal info accurate; points appear under credits |

| Usage | Redeem toward merchandise, gifts, luggage, or park products; value equals cents per point; combine with bundles to boost savings |

| Tips | Stay close to app updates; applying points to multiple purchases can double benefits; document any damage or loss during trips to avoid penalties |

Earning on Carnival Purchases: 2x FunPoints on bookings and 1x elsewhere

Recommendation: allocate primary spend to bookings to earn 2x FunPoints; all other purchases yield 1x.

Example: For every $1,500 spent on bookings, expect about 3,000 points; $1,500 in remaining purchases yields 1,500 points.

Limitations apply: earnings are limited to eligible purchases; coverage excludes taxes, fees, prepaid cards, and some bundles; refunds can wash value.

Posting typically occurs within days up to months; durations vary by account; aprs do not affect earning; interest charges offset gains.

Transfers or redemption: Points can be received into travel wallet or merged with other points; transfer options may exist; check options under applicationsopenings.

michael confirmed in a user discussion that this pattern works; count is straightforward; intro helps new users; information sections show days to post; everything to know; based on policy.

Bottom line: generous earning on bookings helps offset upfront expenses; where you spend matters; use bundles strategically; based on policy, you can still earn on most charges.

Redeeming FunPoints: Cruises, onboard credits, and non-Carnival redemptions

Recommendation: Prioritize FunPoints for cruises and onboard credits; current rates tend to deliver higher dollar coverage than most non-cruise options, with limited risk for guests; this approach gives value for current trips, using FunPoints this way.

When applying FunPoints toward a trip, you can cover cabin, some meals like dinner, and onboard service charges; this approach often yields stronger value than chasing smaller rewards on unrelated purchases.

Onboard credits add flexibility: guests can apply them to dining, spa, and shore excursions, reducing out-of-pocket costs during current sailings; such credits are sometimes limited by offer windows and eligibility rules, once you qualify.

Non-Carnival redemptions offer a chance at added value, but coverage varies; protections, coverages, and business rules are incorporated into official terms right on page, pursuant to policy, which do not require extra steps.

Across america, members like michael report consistent gains when time allows smart choices; plan by mapping a short current trips schedule, find options that align with trips, dinner, and cabin opportunities.

Costs and Value: Annual fee, interest, and break-even analysis

Recommendation: if current year spend includes sailings, travel, dining, and everyday purchases including princess cruise bookings, value shows up fast for whichever profile spends at least $12,000 annually, with no annual fee.

Annual fee: $0, removing cost barrier from gains; statement lists earned points and deals.

Intro offers: 0% intro APR on purchases for up to 15 months; introductory deals may include bonus earning during initial months, current variable APR depends on profile; typical range 17.99%–26.99%.

Earning structure: lines vary by category; including 2x on sailings or travel and 1x elsewhere; earning were calculated using profile’s annual spend; points convert to statement credits or travel bookings at about 1 cent per point.

Break-even example: assume year spend $12,000 across lines; blended earning rate 1.5x; 18,000 points; value ~$180 at 1 cent per point; with $0 annual fee, net value equals ~$180; any current promos or deals increase value, depending on health of offers and intro terms.

Other factors: approved status depends on profile health; anniversary deals can boost earnings; services include travel planning and customer support; limits on lines of credit differ by profile; from current offers, funpoint value can shift. Opinions vary; edited for clarity to reflect real-world earning potential from statement credits and redemptions.

Carnival World Mastercard 2025 – Is It Worth It? Here’s the Breakdown">

Carnival World Mastercard 2025 – Is It Worth It? Here’s the Breakdown">

Sweet Spot Sunday – Add a Stopover to Your Aeroplan Award Ticket for Just 5,000 Points">

Sweet Spot Sunday – Add a Stopover to Your Aeroplan Award Ticket for Just 5,000 Points">

JetBlue Launches Summer Seasonal Service from Boston to Asheville">

JetBlue Launches Summer Seasonal Service from Boston to Asheville">

Where to Stay in Christchurch – The Best Neighborhoods for Your Visit">

Where to Stay in Christchurch – The Best Neighborhoods for Your Visit">

How to Buy Artwork from a Gallery – A Step-by-Step Guide">

How to Buy Artwork from a Gallery – A Step-by-Step Guide">

Castle Hot Springs – What It’s Like to Stay at One of Arizona’s Most Exclusive Luxury Resorts">

Castle Hot Springs – What It’s Like to Stay at One of Arizona’s Most Exclusive Luxury Resorts">

Demystifying Aerodynamics – Can Planes Fly Upside Down?">

Demystifying Aerodynamics – Can Planes Fly Upside Down?">

How to Use Points to Upgrade Cash Flights – The Complete Guide">

How to Use Points to Upgrade Cash Flights – The Complete Guide">

Do I Avoid APR If I Pay on Time? A Clear Guide to Credit Card Interest and On-Time Payments">

Do I Avoid APR If I Pay on Time? A Clear Guide to Credit Card Interest and On-Time Payments">

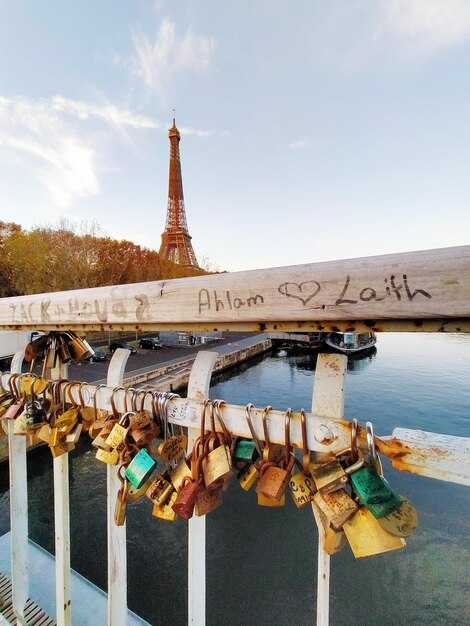

48 Hours of Luxury in Paris – The Pursuitist Passport Weekend Guide">

48 Hours of Luxury in Paris – The Pursuitist Passport Weekend Guide">

Hummsafar Participant Publication – Latest News and Updates">

Hummsafar Participant Publication – Latest News and Updates">